Citizen Comment:

The main topic of the night is the budget, so the main complaint during citizen comment is that taxes are too high. Taxes are too high, and also the city isn’t solving all our problems, which is basically the municipal equivalent of “the food was terrible and the portions were too small!”

(And also, people hating on the bike lanes. Everyone loves to hate the bike lanes. If you love bike lanes, I suggest you let City Council know, because the anti-bike lane people are kicking up dust.)

Confidential to city council: I like the bike lanes. Let’s keep bikers alive.

Back to taxes. I’m going to tell you a little parable of my cat:

I had a lovely tomcat who was scared of the vacuum cleaner. Whenever I ran the vacuum cleaner, he would lose his mind and attack my shoes. He would just beat my poor shoe all to hell. (I tried not to vacuum very often.)

That’s the end of the story!

Here’s the thinly veiled moral: Being mad about taxes is like my cat attacking my shoe. Don’t be mad at taxes for your justifiable economic woes. You are neck-deep in capitalism! Be mad at that! You are right to feel worried that a medical disaster could undo everything you’re working for, or that you might be destitute in your old age, or unable to help out your kids. The real crime is that someone can work fulltime and not be able to cover their basic needs.

If you know, if you truly 100% trust, that you’ll always have clean safe housing, healthy food, and free medical care readily available, then your life is much freer. That’s the paradox: we pretend this is freedom while paralyzing ourselves with anxiety. We’re such a mess.

Anyway, hooray for taxes. Hooray for a social safety net, and if only it were much stronger. We’ll talk more about who gets tax breaks, and what kind of charity that is, a little later on. In the meantime, if you’re still mad about taxes, scroll through this little demo on the scale of economic inequality and get back to me.

One comment that’s not about taxes: Virginia Parker spoke on behalf of the San Marcos River Foundation. Basically:

- Everyone is freaked out by the river and parks right now

- The summer was so hot, the river is so low, the parks are so overused

- We desperately need more park staff and marshalls. (These are her words. I’m not totally clear on what the marshalls do.)

- We should have paid parking with free passes for residents to help offset costs

- Only remaining vegetation are those fenced off Habitat Protection areas, and keeping that vegetation is crucial to keeping the river clear

- We’re spending a bunch of money to promote tourism, but with the river in its current state, that’s kinda irresponsible.

Item 13: The 2024 $315 million dollar city budget.

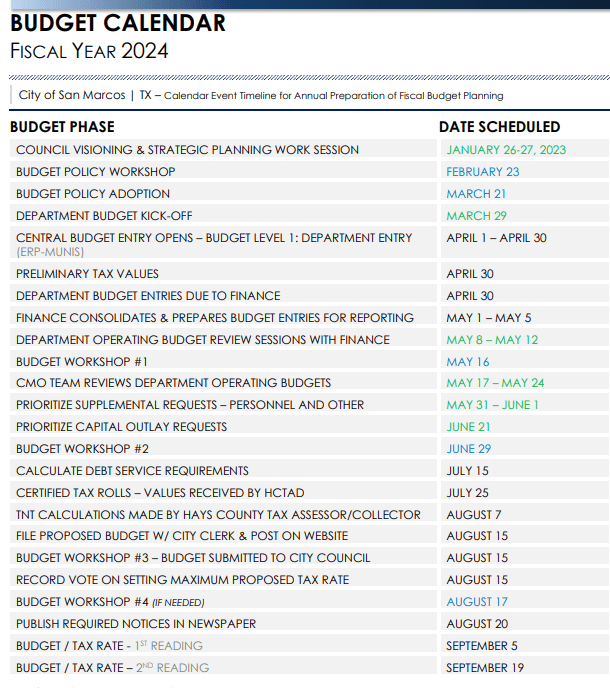

It takes 9 months to birth a budget. Here’s the basic timeline:

At the workshop last January, Council came up with their goals that are supposed to shape the whole process:

They are all important, but public safety was the one that council really hammered, over and over again. “Public safety” can mean so many different things to different people! Do we mean lifting people out of poverty? Do we mean vocational training for ex-offenders as they transition to private life? Do we mean hiring more cops? (We definitely mean hiring more cops.)

The budget has a ton of moving parts, obviously. Here’s the bird’s eye view of the whole thing:

Here are the major points that were emphasized:

Note:

- The compensation study is to help us retain city staff. This is important – high turnover is incredibly expensive. Also, it’s just good manners to compensate people fairly.

- The Human Services Advisory Board money is the money that the city gives to local nonprofits.

- New city hall: there’s a state law that you can’t borrow money for a city hall building. (It’s wild what the state legislature will micro-manage.) So if your city hall was built in 1975 and you’ve outgrown it, you have to sock money away under a mattress until 2075, when you’ll be able to afford your new city hall.

- Capital Improvements Program: this just means city projects and repairs. Fix the stormwater drainage in this neighborhood, add in sidewalks over there, etc.

So is this a good budget? Does it achieve those five goals? I don’t know!

Last year, city staff presented Council with 2 similar plans, and they debated them. Would we go with 59.3¢ or 60.3¢ tax rate? Would we use the extra $700K on cops and firefighters? Last year, Chief Stephens and Chief Standridge came in person to plea for personnel. This made it easier for me to understand those aspects of the budget being discussed.

This year, there was just one budget and just one tax rate proposed. No debates. No lingering questions posed. City council basically didn’t say anything besides thanking staff for their hard work. (And I listened to most of the workshops, and never heard much arguing there, either.) There are two possibilities:

- Staff is just great. They’re producing top notch budgets, and there’s not much to argue about.

- No one on council has strong feelings about these things, and no one has an angle to dig in and get heated up about anything.

Probably both are true? It’s very hard to figure out what people are thinking when no one says anything substantive.

Here is the actual budget. It’s pretty readable! It’s just hard to evaluate.

Item 14: the tax rate

We’ve been over the different tax rates before, so I’m going to save my pixels and just use the city’s slide:

The 60.3¢ rate is the same as last year. Of course, inflation’s been a thing. So how much are taxes going up?

The average home went from $294K to $338K, so the average homeowner’s city property taxes are going from $1,686 in 2023 to $1,949 in 2024.

Details:

(Now, this is only part of your tax bill. You also pay SMCISD and Hays property taxes.)

Let’s talk about the (15,000). That’s the homestead exemption. In other words, you get a 15K discount before we charge you property tax. This was created in 2022. It also gave seniors and people with disabilities a 35K deduction.

Was this a big deal? Yes and no:

It costs us about $1.1 million dollars, out of $315 million budget, to do so. Every home owner in San Marcos gets to evenly split $1.1 million dollars. None of them think that they just got a $90 bonus check from the city, but they did.

Here’s the thing: We spend $550K on funding various nonprofits around town. (This is the whole Human Services Advisory Board thing.) We hem and haw and dole out $15K here and $25K there, and make nonprofits put in a ton of work for little amounts of money.

At the same time, we spend twice as much on charity to people who own their own homes as we spend on all other nonprofits, combined. San Marcos is 75% renters! That handout is only going to 25% of the population!

Some home owners are rich. Others are definitely not. Being house-poor is definitely a real thing, and we need to help house-poor home owners. All I want is for the homestead exemption to feel like the city sent you a physical $90 check. It should not be invisible.

If I had a magic wand, I’d say that everyone must pay their full tax bill – federal and local – and then any deductions would get mailed back as a refund. Subsidizing the rich should feel as tangible as subsidizing the poor.

(Why not just cure poverty with your magic wand? oh hush.)

…

Items 15-18: Your utility and water rates are going up. I’m sorry. Sort of. Channel your anger towards structural inequality.

For electric, we’re still the cheapest around:

Don’t let anyone ever talk about privatizing public utilities.

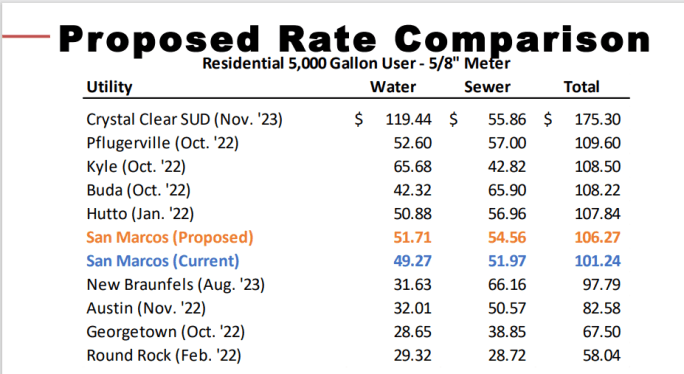

Here’s our water rate:

Well, it’s mid, as the kids say.

Staff says that one of our biggest water expenses is a $1.4 million contract with Alliance Regional Water Authority.

I can’t actually find the contract in the budget, so I don’t know what we’re paying yearly:

I see Alliance Water Revenue, but not an expense. (I must be looking in the wrong place, idk.)

What is this contract? Basically, in 2007 we got some funding from the state to build this organization with Kyle, Buda, and the Canyon Regional Water Authority. We drilled 4 wells, and we’re laying a bunch of segments of pipes, and some storage tanks, and a water treatment plant.

The water looks like it comes from the Carrizo-Wilcox Aquifer, which is here:

So not TOO far away.

Carrizo water needs to be treated – it’s got more minerals and salt in it than surface water or Edwards Aquifer water. But it sounds like there’s a LOT of it. During the Council meeting, staff says that this is supposed to be a 40 year plan for getting us water. I can’t find that promise written down anywhere though.

Either way: water rights are going to be a big, messy fight coming up in the future. It’s good that we’ve got at least somewhat of a plan.

…

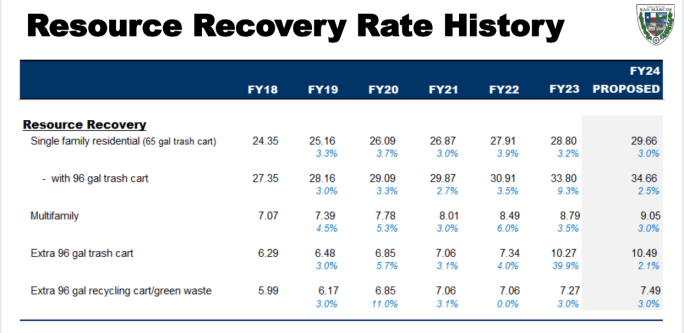

Along with water and electric, there’s also garbage and recycling:

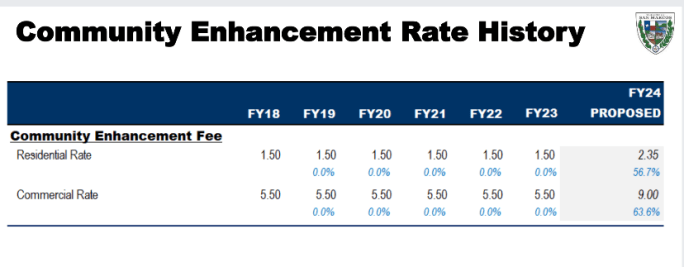

and also a Community Enhancement Fee:

So if I’m ballparking all that, your rates for all these services is going from:

58.20+49.27+28.80+1.5 = $137.77

to

59.43+51.71+29.66+2.35 = $143.15

So your monthly bill is going up $5.38.

(This isn’t exactly right, because I don’t know how much electricity and water the average household uses each month. I have to assume the city gave us monthly quantities.)(They actually mentioned the total increase at one point, but I missed it, and now I can’t find it.)

San Marcos is not rich. If you are struggling, consider the Utility Assistance Program, why doncha? (That’s Community Action, but the city partners with them.)

Full disclosure: the Utility Assistance application form is a little intimidating, at least to me. It is not Community Action’s fault that their application is cumbersome. It’s the culmination of a maze-like system of scrabbling for peanuts that we impose on nonprofits.

When I say my fantasy is a strong social safety net, my fantasy is also that it will be very easy to use.

…

There were two moments that I want to share:

- The vote to raise the utility rate by 5%:

Yes: Jane Hughson, Mark Gleason, Jude Prather

No: Shane Scott and Saul Gonzalez

Absent: Matthew Mendoza, Alyssa Garza.

WHOOPS. It takes four votes to pass. So since Matthew Mendoza and Alyssa Garza were absent, it failed.

You could practically hear City Manager Stephanie Reyes’ stomach plummet through the floor, although she is the most poised person on the planet. She politely explained that we’ve now blown a giant hole in the budget, and we’ll need to revise it, and that we may need a special session in order to get everything passed by October 1st.

With that, Shane Scott offered to switch his vote, which I’m sure was a massive relief. He explained that he just reflexively is a “no” on rate hikes, but didn’t actually want all those consequences to come crashing down.

The re-vote:

Yes: Jane Hughson, Mark Gleason, Jude Prather, Shane Scott

No: Saul Gonzalez

Absent: Matthew Mendoza, Alyssa Garza.

Phew.

- Matthew Mendoza was absent during the utilities conversation, but he arrived in time for the Community Enhancement Fee conversation. This is small, but it irritated me:

Matthew asked, “What if an evicted person decides to throw all their stuff all over their front yard? Can this fee help with that kind of thing?”

Listen: don’t phrase it like that. A yard full of possessions is mostly a sign that someone’s problems are too big for them, and I don’t mean the landlord.

Also, it’s just plain wrong. Evicted people don’t throw all their stuff all over their front yard. Evicted people just left their stuff exactly where it was, and did not move it one inch. Someone else got mad – like an ex-boyfriend or ex-girlfriend – and threw out their stuff, or the landlord moved it all to the curb.

(The answer was no, Matthew, you cannot use this money for that purpose, why would public money be used to help landlords clean up after tenants.)