Citizen Comment:

There was a big turnout tonight! 21 speakers total, and more speaking at public hearings later during the meeting. The whole citizen comment lasted over an hour.

The main topics were:

- The can ban, by far. People who do the work of pulling trash out of the river have a lot to tell you about why we need to ban single use containers. 16 of the speakers talked about this, including the mayor and some councilmembers from Martindale.

Some notes:

- It would actually be a ban on all single-use containers.

- New Braunfels and Martindale both have bans, and they’ve made a huge difference. Plus you save money on trash clean up.

- The key is to educate and get buy-in from residents. Not just ticketing people.

2. Selling our water from the Edward’s Aquifer to Kyle

- For the second year in a row, Kyle has run out of water and wants to buy some from us.

- Virginia Parker, from the San Marcos River Foundation, talks a lot about this: their conservation efforts are shoddy. Sell them the water, but make it contingent on tighter water conservation.

- The city doesn’t agree with SMRF’s criticism. We’ll talk about this when we get there.

3. The taxes are too dang high

- There weren’t actually a ton of people who showed up in person, but council comments give the impression that they’ve been swamped with complaints behind the scenes.

4. Notification radius for development agreements – it should be appropriately large

- This is mostly about the SMART Terminal, and how no one knew ahead of time that it was a thing, until it was too late. But it’s also happened with other issues, too.

- The city is going to start sending notifications to neighbors in these situations. They’re offering a 400′ notification radius. The problem is that the SMART Terminal is supposed to be 2000 acres, which is 87,120,000 ft2. The 400′ notification is the tiniest sliver around something that big.

- As we’ve said before, the notification radius should be proportional to the size of the project.

Finally, Dr. Rosie Ray offers some good improvements for the Comp Plan, but I’m going to save those for the VisionSMTX discussion so that I can put them in context.

…

Items 5-8, 16-18: The budget, the tax rate, and the rate hikes.

We talked a lot about the budget here last time, and I was an insufferable blowhard about the virtues of paying your taxes. (I still am! Sorry!) So I don’t think we need to recap all of that.

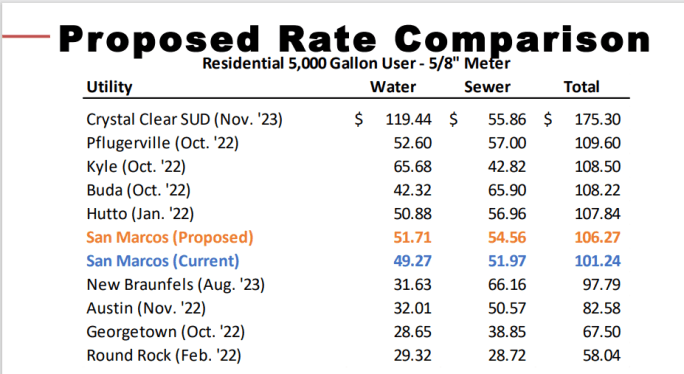

The short version: the tax rate is steady, but housing prices went up, and so the amount everyone pays is going up. Also utilities are going up.

Clearly councilmembers got an earful about property taxes and the appraisal process. I can’t tell if people are mad that appraisals are so high, or that appraisals are done poorly. If it’s incompetence, that’s a different problem than skyrocketing costs.

This is a useful slide, which is totally illegible:

Would you like it to be clearer? ME TOO. Unfortunately, this slide is not in the packet, and so I had to take a shitty screenshot.

If you promise that I’m your favorite blogger, I’ll transcribe the damn thing for you:

| 2022-2023: Average monthly bill | 2023-2024: Avg monthly bill | Monthly increase | |

| Electric | $93.01 | $94.72 | $1.71 |

| Water | $56.47 | $59.29 | $2.82 |

| Wastewater | $48.26 | $50.67 | $2.62 |

| Stormwater | $14.90 | $14.90 | 0 |

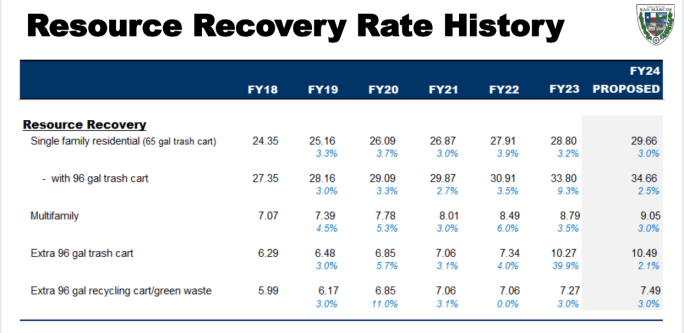

| Resource Recovery (ie trash and recycling) | $28.80 | $29.55 | $0 |

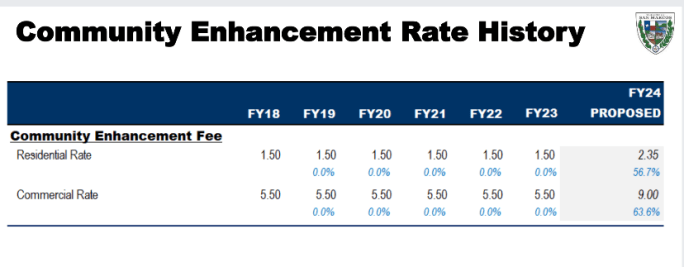

| Community Enhancement | $1.50 | $2.35 | $0.85 |

| Property Tax | $160.53 | $182.42 | $21.89 |

| Total | $383.47 | $414.01 | $30.54 |

All of those are based on a $338K house and average usage.

Listen: $414 is a lot of money per month. I don’t want to be flippant about that. In addition, you’re paying SMCISD and Hays county taxes, at a rate of $1.133782 and $0.3125, respectively. So that’s another $3832.18 to SMCISD and $1056.25 to Hays County, which works out to a monthly total of $821.38 per month.

That stings! BUT.

1. The first problem is that we’re bringing the sting of paying $821.38 to a conversation which is really only about the property taxes part, which is $182.42.

2. The next problem: there’s actually not much to cut. Core services are really important. The city actually runs a lean budget. You are getting mostly-maintained roads. You are getting smart people with degrees to make sure that the buildings are safe and conform to what we have all agreed that we want buildings to do. You’re getting libraries and librarians. You’re getting a phenomenal park system and park staff that work there. You’ve got cops that will (mostly) show up if you’re in danger and (hopefully) arrest the right person (that’s a conversation for a different day.) You’ve got firefighters to show up if you have a fire. And you’ve got to pay all these people fairly. That $182 is going to really important stuff, and I’m sorry that it’s invisible, but it’s as important as keeping the lights on in your house.

3. We can reduce the tax burden through city planning – increase density in gentle ways.

Listen: single family neighborhoods do not bring in enough tax revenue to pay for themselves. Cities compensate by taxing apartments and business at a higher rate. If you live in a house, you are already being subsidized by apartments and businesses.

We’ll talk about this a LOT later.

4. You should absolutely be angry, because the rich should be paying so much more.

Both locally and statewide, taxes are super regressive – 2nd worst in the country, in fact! The poorest 20% of Texans pay 13% of their income in taxes. The middle 60% pay 9.7% of their income, and the wealthiest 20% of Texans pay only 3% of their income in taxes. This is utter bullshit.

This is because the main tax at the state level is a sales tax. Sales taxes are the most unfair taxes. If you live paycheck to paycheck, you get taxed on your entire paycheck because you spend everything you earn. But the wealthier you are, the more buffer you have between the money you spend (and get taxed on), and the money you put in investments, tax free.

San Marcos also has a 2% sales tax. Obviously this is in order to cash in on the outlet malls, but it’s also another flat tax hitting our poorest residents the hardest. In fact, we actually bring in more money from the sales tax than property taxes: the sales tax brings in $42 million, the property tax brings in $37 million.

Remember the part about how poor people pay 13% of their income in state and local taxes? They are only earning $14,556 a year. The state makes $2037.84 off that poor guy.

Whereas the top quintile paying 3% of their income? They earn $228,924 on average. The state makes $6,867.72 off the rich guy.

If you taxed the rich guy at 13%, Texas would get $29,760, and he’d still have almost $200K left! We could do so much more to alleviate poverty and help communities, if we taxed the rich fairly.

5. Property taxes are not as unfair as sales taxes. They’re not great, but they’re not the worst. But you know what’s the ACTUAL WORST? The state proposal to use a surplus from sales tax to refund property taxes. Texas is literally going to redistribute money from the poor to the rich. This makes me lose my goddamn mind.

(If you think that landlords will lower rents with that money, you are high on your own supply.)

And the state needs that money! Might I suggest using it to REPAIR THE GODDAMN FOSTER CARE SYSTEM?

You guys, this conversation is making me sweaty. I need to bring it back to local issues again.

…

Sorry. I got really shouty. Ahem.

…

Let’s start from the beginning.

Utility rate hikes: water, wastewater, trash/recycling, and community enhancement are all going up a little. On average, you’ll pay $8/month more.

The Vote (tucked inside the consent agenda)

Raise them rates! Jane Hughson, Shane Scott, Jude Prather, Matthew Mendoza, and Mark Gleason

Don’t you dare: Saul Gonzales and Alyssa Garza

I strongly disagree with Saul and Alyssa on this vote. These are four areas where responsible use can drive down costs. We need to be mindful when we’re taking a long shower, or lowering the AC, or watering the lawn. Don’t subsidize people being wasteful.

These rates should be priced so that each fund is self-sustaining. Separately, we should fund utility assistance for those who can’t afford the cost. In other words, we should keep doing exactly what we’re doing.

…

Next, the budget conversation.

The public hearing:

- City staff made some 3 minute videos to explain the budget process to the public. They got like 50 views total. [Scroll down here if you want to see them.] That’s not successful. None of you shared those videos on social media or anything. None of you held town halls.

- We pay money to contractors to do big surveys and we don’t use the results.

- City staff is paid too much under this budget.

- We’re taxing people out of their homes!

- There’s no transparency and no environmental accountability!

Let me single out one speaker, Noah Brock, who is making a very different, specific point:

- The Highway 80 Utility project only connects to two properties: some city property and the SMART Terminal property

- The water and wastewater funds directed to this project have spiked hugely:

– It’s going to use $10 million /60% of the water fund. This was 1.5 million last year.

– It’s going to use $15 million /49% of wastewater. - Why are you raising rates 5%, and then directing $25 million for the SMART Terminal?

I have no answers.

Council discussion

Saul Gonzalez asks about freezing property taxes for anyone over age 65. He brings this up several times throughout the night. Do other cities do this?

Answer: Yes, cities like Killeen do this.

Saul asks how they make up the revenue?

Answer: their tax rate is higher.

(I don’t think Saul likes this answer.)

Next up is Alyssa: She is a no on this budget. We’re not fixing our problems. Incremental change is not meaningful change. There’s a lack of transparency and participation. We need a more equitable process and we need to provide tax relief. We’ve got big problems – we need good paying jobs, we need affordable housing, we need to help the homeless. We’re doing nothing on those problems.

Jude Prather: This budget achieves those five goals we laid out! It’s great.

Mark Gleason: I wouldn’t be voting for this budget if we weren’t going to get all this property tax relief from the state.

(Yes – that sales tax surplus from all Texans that will go to just property owners. How nice for some.)

Shane Scott is totally in campaign mode. He hasn’t given a speech all year. But here we go:

- Since he was first on council, the budget has gone from 1.5 million to 3.5 million

- He fights for the lowest costs.

- “They should be paying for OUR lifestyle – we were here first!” I have no idea who he has in mind with this, but sure.

- Cost of food, single moms

- He doesn’t want to risk lowering our bond rating.

- Safety, hooray!

- Participation, hooray!

And my favorite part: voting on this budget literally makes Shane Scott puke… but he’s a yes.

Jane Hughson: Look, the property taxes are going up $22/month. I’m a yes.

Matthew Mendoza: I want to puke too, just like Shane! But I’m a yes.

So everyone has staked out their basic positions on the budget.

…

The conversation then turns meta

What went wrong that everyone is so unhappy at the final stage? We’re going to have a big conversation on this. Here’s the positions that everyone stakes out:

- There’s an 9 month process and we’ve given you tons of opportunities to share why you’re unhappy. This is bullshit to bring it up now. (Jane, City Manager Stephanie Reyes)

- We’ve said that we’re unhappy at every step of the process! And we have an obligation to represent the unhappiness of the community, and the community is freaked out by property taxes. (Saul, Alyssa)

- It’s no one’s fault – it’s the appraisal calendar and the tight turnaround, and how difficult it is to communicate with the public. We feel great shame. (Mark Gleason, Matthew Mendoza)

- Wait, I thought we agreed that everything was great. (Jude)

- I already gave my one speech, why are we still doing this (Shane)

Here is how the conversation unfolds:

Jane Hughson says to council, “Save these speeches for January, when the next budget process starts up again. Voice these issues during the Visioning Process.”

In other words, if you all are mad about different things, use the budget process. Bring this up from day one.

Alyssa counters, “The Visioning Process does not work. It has nothing to do with the actual needs of San Marcos. It’s tone-deaf. Stop romanticizing the strategic goals and using them to accept the status quo.”

This is true – the budget process takes last year’s budget, and tweaks it incrementally, according to Council direction. It cements the status quo for another year. It’s never going to produce transformational change, which is what Alyssa is here for.

Alyssa believes sincerely and deeply in citizen participation – this is how she’d fix the budget process. This is where I disagree. First, I’m a little more cynical: everyone’s busy. I don’t think there’s an outreach effort on the planet that will engage a real number of citizens until they see the price tag, at the very last minute. (And frankly, people can be idiots about how to run a town when they do show up.)

But note: Alyssa is not proposing a concrete, alternative budget with different priorities that she can point to. This is why I’m interpreting her vote as a protest vote against a complacent status quo, and not a counter-proposal for a realistic alternative.

This next exchange is really crucial:

City Manager Stephanie Reyes:

“This is disheartening. This did not happen in a vacuum. We rely on each of you, as elected officials, to talk with our neighbors. You represent your constituents within the community. We expect to hear a diverse set of thoughts and ideas at every meeting. Every budget meeting has been in an open forum, with citizen comment and Q&A afterwards.

“You hear a lot about the things that city staff does not-so-good, and there’s not a lot about the things that we are doing that are going very well within our city. And that is very frustrating, because that is what staff hears. Staff gets a lot of bad raps, but they’re carrying out Council direction that you all make as a group.

“I also hear “hey, we can’t tax our neighbor out of their home” but I also hear “oh we don’t want commercial development” or “oh we don’t want these things”. We can’t have more and more and more and not have anybody to pay for it. Somebody’s got to pay for it. So either expectations need to come down, and what gets asked of city staff to do more, or we need to temper our expectations in a way that is within what we can afford.

“Staff is not formulating this budget in a vacuum. It’s a conversation, it’s been a dialogue, there have been different junctures, we’ve gotten direction from each one of you, every step of the way. And now at the end to make it look like it’s just our budget? I just don’t think that’s necessarily a fair way to portray that.”

(I shortened and edited her words, but I don’t think I misrepresented her. It’s at 1:53 if you want to listen for yourself.)

Alyssa replies:

“I hope you’re not trying to imply that my discontent is news to you or anybody else. I hear your frustrations. Let me take a second to share mine. I feel that staff feelings are constantly weaponized to foster this sense of guilt about speaking up. That’s my perception. I think the way I treat staff every day speaks to the fact that I value staff. I try to give kudos whenever kudos are merited, I try to have grace, I try to advocate for better things for them. Staff works hard, strides have been made on this process. That’s a fact.

“But multiple truths can exist at once. They don’t have to be in contradiction of each other. All that’s true. But it’s also true that it’s very little and these concerns from our community are not new. It sucks that you guys inherited this. I’ll just share this: when you know the caliber of what you’re working with and you know the possibility of what could be delivered , you just have really high expectations, and I think that’s what our neighbors are expecting with this whole new leadership and leadership style.

“So if it’s coming across as being dismissive or trying to intentionally hurt staff’s feelings, that’s not my intention. It’s my responsibility to echo my constituents’ frustrations. And it’s not just the ones I see, it’s decades worth of historical frustrations. And again, it sucks that you guys inherited this, but that’s just the way it is.”

(Not really edited at all. Alyssa’s very eloquent.)

They really are both right, and it’s not a contradiction. Staff solicits council input. Council ignores Saul and Alyssa and votes to stick with the status quo. Staff takes council direction and implements it. The community gets mad and blames staff.

[Here is one more truth: you will never escape “the community gets mad and blames staff.” No matter how amazing your process is, that’s how it will always end.]

Their exchange was so powerful and raw. It kind of cracked me up to hear everyone else chime in after for a piece of it:

Mark: omg omg! I’m so sorry. It’s just the calendar of when numbers become available! You guys get so many kudos. Covid AND inflation! Huge kudos. Teams. It’s just communication.

Jane Hughson: hooray for staff!

Saul: I too heart the staff! My constituents are broke. Let’s freeze taxes for those over 65.

Matthew Mendoza: We all failed. We didn’t fight hard enough. I blame me.

The vote on the budget:

Yes: Jane Hughson, Jude Prather, Shane Scott, Matthew Mendoza, Mark Gleason

No: Saul Gonalez and Alyssa Garza

…

But wait! There’s more!

Next, they have to vote specifically on the property tax increase. By Texas state law, this has to pass by 5 votes. (Last year, Saul, Alyssa and Max all voted against it, and almost blew up the process. In the end, Saul switched his vote. Alyssa and Max were protesting all the extra cops.)

More public hearings

Max Baker packed 50 ideas into three minutes. LMC channeled Milli Vanili. Former councilmember Lisa Prewitt and former school board member Juan Miguel Arredondo both showed up to talk.

I don’t know how to boil it down, so I’m just writing it out.

Max Baker:

– We don’t have it’s own economic development person. We rely on GSMP.

– Maybe there are technology solutions! Why don’t we fight for those solutions to the budget?

– Why wait for January? Start now.

– Community blames staff because staff are the experts. We’re stuck with what you give us, and you get defensive.

– People also ask for FEWER Cops. The Cops are the ones that ask for more cops. Other conceptualizations of safety.

– when do we stop giving big corporations all these tax breaks?

– Appraisal problem, cover for “not raising taxes”

– why don’t we make sure people get their appraisals, and why don’t we help people protest their appraisals?

– Y no accountability? Burt Lumbreras said we should stop giving tax breaks, because it will blow a hole in the budget, but GSMP said we need it, so we did it.

– year after year, you claim you’ll fix it next year.

(This is generally what I mean when I say Max puts 50 ideas into 3 minutes. It’s a lot.)

LMC

– Sings Milli Vanilli. Staff uses a big city consultant to give themselves a 5.5% raise. And we have to cut costs. Waste in the budget. You all don’t read your packets.

Juan Miguel Arredondo

– Tax rate: I represent people who live on the margins. Those who have trouble fixing their car and buying groceries. They don’t get to decide that they are going to get pay raises to keep up with inflation. There’s no fund balance. They just have to do more with less. That’s what you have to do, too. Your choice will cause poor people to make hard choices.

Lisa Prewitt

– ditto everything. everyone is right from their own perspective and we can’t judge. But I did the Visioning workshop for six years and we did talk about freezing seniors. We’re all in this together. We’re all trying to budget ourselves at home. Medical, medicine, groceries, utilities. Our seniors are vulnerable. They can’t get a second job or come out of retirement. When do people get a break? Another 5-10K per year? You can’t tax people out of their homes!

…

Look: clearly I disagree with these speakers. I don’t think that we should slash the budget to give people a tax break.

I know times are tight. But you absolutely cannot lift someone out of poverty with a tax break. You can break poverty by raising the minimum wage to keep up with inflation, and implementing well-designed social programs, affordable healthcare and housing, and wealth redistribution. But not with a $500 tax cut.

City staff deserve to be paid fairly. The budget is lean. Nevertheless, we’ll talk in the next section about how to reduce the tax burden.

Spoiler: no one wants to do it.

Council conversation

It’s more of the same:

Saul

Saul goes back to his thing about freezing taxes for seniors: I want to ask Juan Miguel Arredondo about how the school board freezing taxes for seniors. Did you all do that?

JMA: I wasn’t there, and it’s complicated, and we went into debt.

Saul: How do appraisals work, anyway?

Answer: Houses are appraised on January 1st. And remember, there’s a 10% cap. And remember, you can protest your appraisal and get it adjusted downward.

Saul: All my appraisals went up and I had to raise all my rents.

Jude

Jude: Look at all these good things! Tax rate is steady, homestead exemptions, state tax relief will be retrospective!

Alyssa

Alyssa: What should I say to our neighbors when they say that we should use the general fund to close the shortfall?

Answer: Tell them it’s not sustainable. The general fund is for one time expenses, not recurring expenses.

Alyssa: How are we helping renters? I’m concerned about utility increases, which disproportionately impact renters.

Note: this is not entirely true. Living in an apartment is much more environmentally efficient than a house. You get some savings on heat and AC because you’re insulated by other apartments. You’re not playing dumb games trying to keep your yard green in a historic drought. You’re presumably sharing the trash/recycling bill in some form.

Mayor Hughson

Jane: Appraisals are legally required to rise and fall with what people are actually paying for houses. The sales prices skyrocketed last year. Nothing sneaky happened. They seem to be cooling, they could come back down.

Mark

Mark Gleason, being smart: I’m not in favor of freezing property taxes for those over 65. Instead, we can increase their homestead exemption on a regular basis. That helps the poorest homeowners more than it helps the wealthiest homeowners.

Note: I agree 100% with this. Some seniors are rich and have million dollar homes, and you don’t need to freeze their taxes. Homestead exemptions help house-poor home owners more than wealthy home owners.

The Exciting Conclusion

Alyssa: Can we change the tax rate?

Answer: Yes. It would blow a hole in our budget. But we’re under a time crunch – if we don’t pass a budget by September 30th, we automatically revert to the 0.503 tax rate. This would cost us $6 million.

Stephanie Reyes: THE TIMELINE. THIS DID NOT HAPPEN IN A VACUUM!

Alyssa: OUR NEIGHBORS. THEY ONLY JUST HEARD ABOUT THIS AND ARE VERY MAD!

Shane Scott: Can we make it up in sales tax?

Answer: We’ve gotten a $1.6 million surplus recently, but we really can’t use that for recurring expenses.

Alyssa: I’m a no. I’d take vacation and do whatever it takes to rework the budget by October.

Mark Gleason: The time for this was two months ago. I know the public doesn’t become aware until the 11th hour. When we have overages, it goes to public safety, like I wanted. We just literally can’t change it at this late an hour.

Saul: My constituents want more services for less tax.

Jude: Political instability is bad for fiscal stability! This should be a 7-0 vote. We should have hammered this out all year.

Alyssa: I’ve been saying this ALL YEAR. And these are my neighbor’s concerns, not mine.

Matthew: How would not-passing the tax rate work?

City Manager Stephanie: DON’T YOU DARE. Please.

The vote:

Set the tax rate to pay for the budget we already passed: Mayor Jane, Shane, Mark, Matthew, and Jude

Blow it up to smithereens! Saul and Alyssa

…

One Final Note

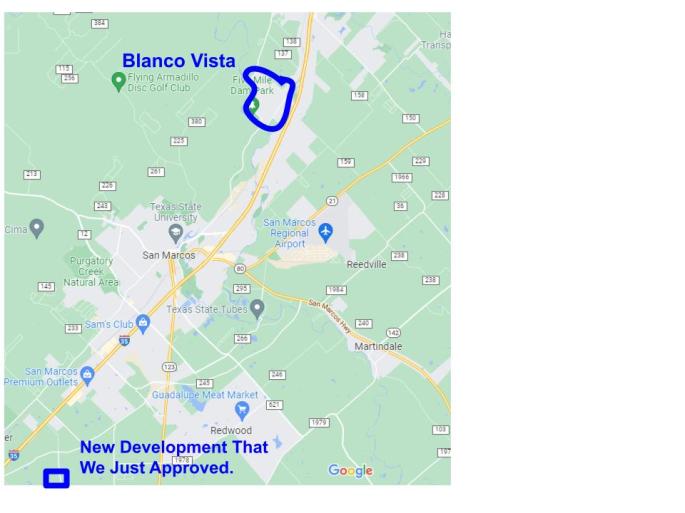

The thing that kills me about this conversation is that no one connects it with the VisionSMTX conversation. Single family housing sprawl is a wildly expensive way to run your city!! Every single aspect of your city costs more! Running infrastructure down to Trace, out to La Cima, up to Whisper, and out east to the new Riverbend Ranch is what’s stretching our resources so thin.

You must put more people in these areas. Gently densify things – allow duplexes and triplexes, allow ADUs – you share the tax burden among more people, and tax rates can go down.

(Also, quit just putting giant apartment complexes on the edge of single family sprawl. Economic integration is important.)