Citizen Comment

Just three speakers! Topics:

- Support for the tenants right to organize ordinance

- The San Marcos Civics Club is hosting another upcoming Reasons Not to Vote rally. (The name still hurts my soul but whatever)

- Support for the

El Centro land purchasepurchase of land next to Centro and the city home repair grants.

Nobody spoke about the budget. Nobody complained about the tax increases being too high. Can we just put a pin in this for later? Let’s remember this.

…

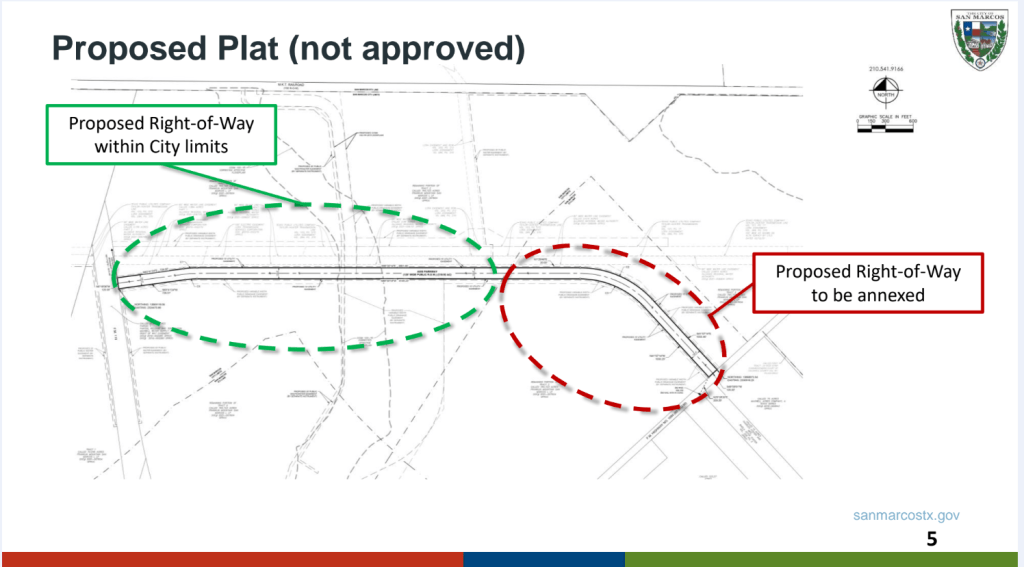

Item 22: Hazmat Routes

You know these guys. You love these guys:

They live in our lovely river, but nowhere else. It could be catastrophic if there was a crash on I-35 over the river, and a bunch of hazardous chemical were spilled into their habitat.

What cities do in this situation is design a Hazmat route. Here’s what we’re proposing:

That’s along FM 150. So you’d cross the San Marcos river well east of the habitats of those critters, if you were driving a truck full of something nasty.

A few notes:

- This is only for thru-traffic. If you’re delivering somewhere in San Marcos, you can head there.

- This is going to be a long process – it’s gotta go back and forth with TxDOT a few times.

Kind of related: remember when the train derailed in East Palestine, Ohio, with all those toxic chemicals?

(and they tried to get away with paying each person something like $5 for wrecking their lives?)

We also have a lot of trains crossing our river! I doubt you can re-route trains quite so easily, but I wonder how environmentalists think about and plan for these risks.

…

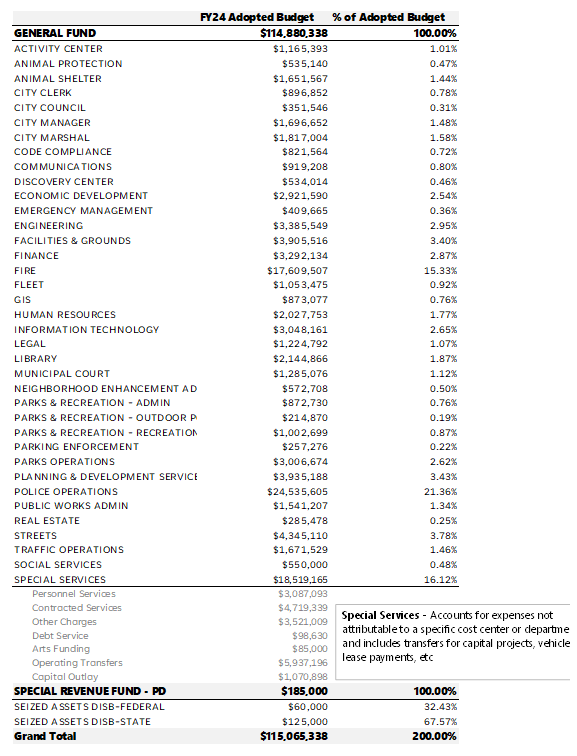

Items 23-25: The budget and the tax rate

I’m sorry, this item gave me whiplash. This went off the rails. Not the good kind of roller coaster.

We need a fair amount of backstory. The drama on Tuesday unfolded so fast that it will be incoherent, unless I bring you up to speed, first.

I’ll try to keep it zippy!

Background

First thing to know: we have not raised our property tax rate since 2022.

Politicians genuinely hate raising taxes. Politicians like being liked! They like being elected. I don’t know where we got this idea* that they rub their palms together and cackle about bilking tax-payers, but they don’t do this.

Polititians love short-term easy decisions that make tax-payers happy! Raising taxes is the opposite of that.

*It was Reagan.

….

The budget process

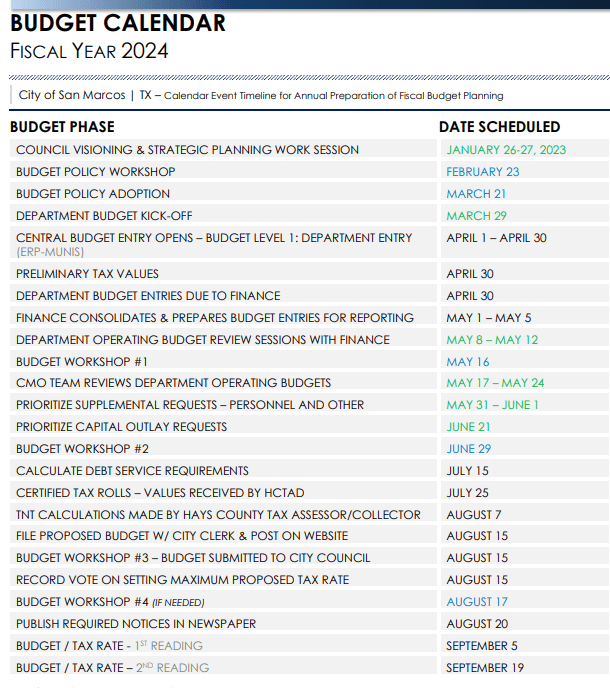

1. January-February-March-etc: they hold some giant two day workshops. Councilmembers develop their priorities for the next year. More workshops. Very slow grind.

2. May-June: The first tax estimates come in: we’re in a budget crisis. We can squeak by this year, but we’re facing a budget cliff.

Roughly speaking, this is the problem::

- Our sales tax is down.

- Our property taxes are down (because home prices are declining)

- Inflation is up.

- We are as lean as we can go. We have already cut $100K from departments.

- We’ve got some big expenses looming. (Covid money ending.)

- The state government is trying to strangle cities.

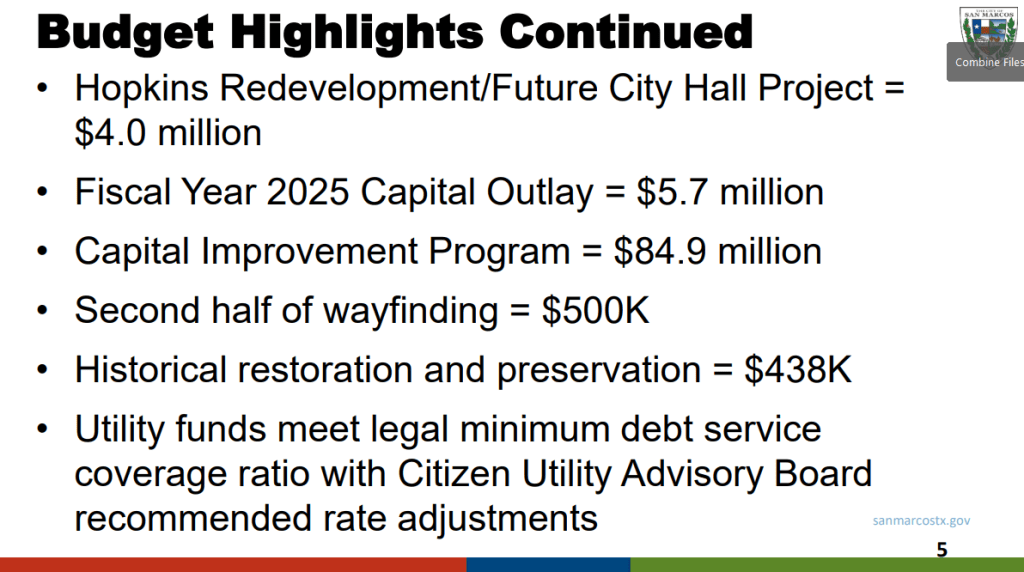

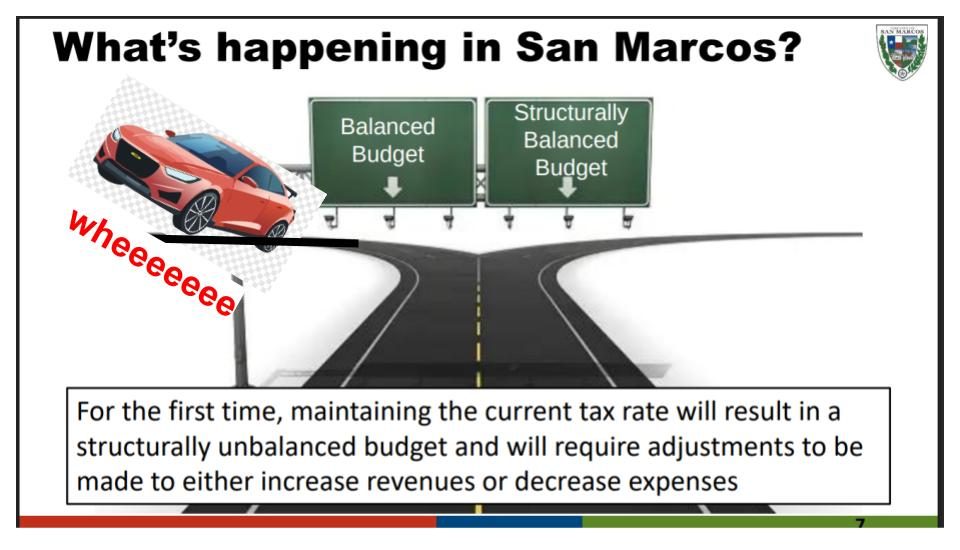

Here’s the graphic that they showed:

It was a big Come to Jesus Moment. Council went to Jesus. They gave direction that they wanted to go with the Structurally Balanced side of that road.

Bottom line: “Structurally Balanced” means raising the tax rate modestly over multiple years (instead of one big crazy future hike.) All of council agrees with it.

…

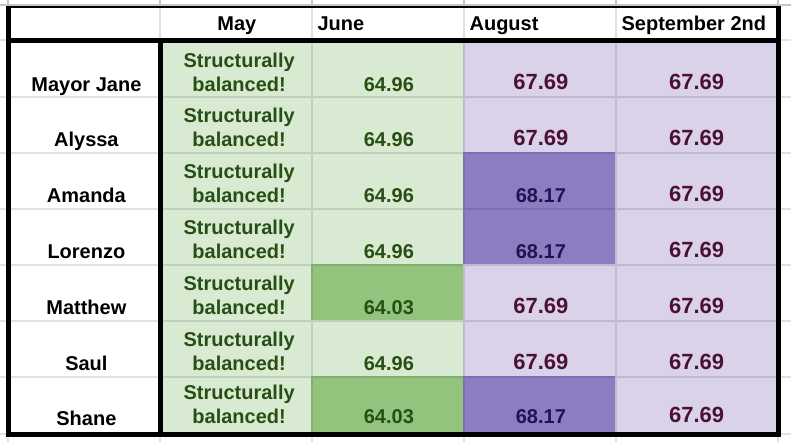

June: In June, staff comes back with some Structurally Balanced tax estimates:

Here’s what everyone said they wanted:

Ok, great! We’re getting somewhere.

….

August: Real numbers come in. (June was just an estimate.)

By law, council has to set their own upper bound, in August. It’s a weird quirk.

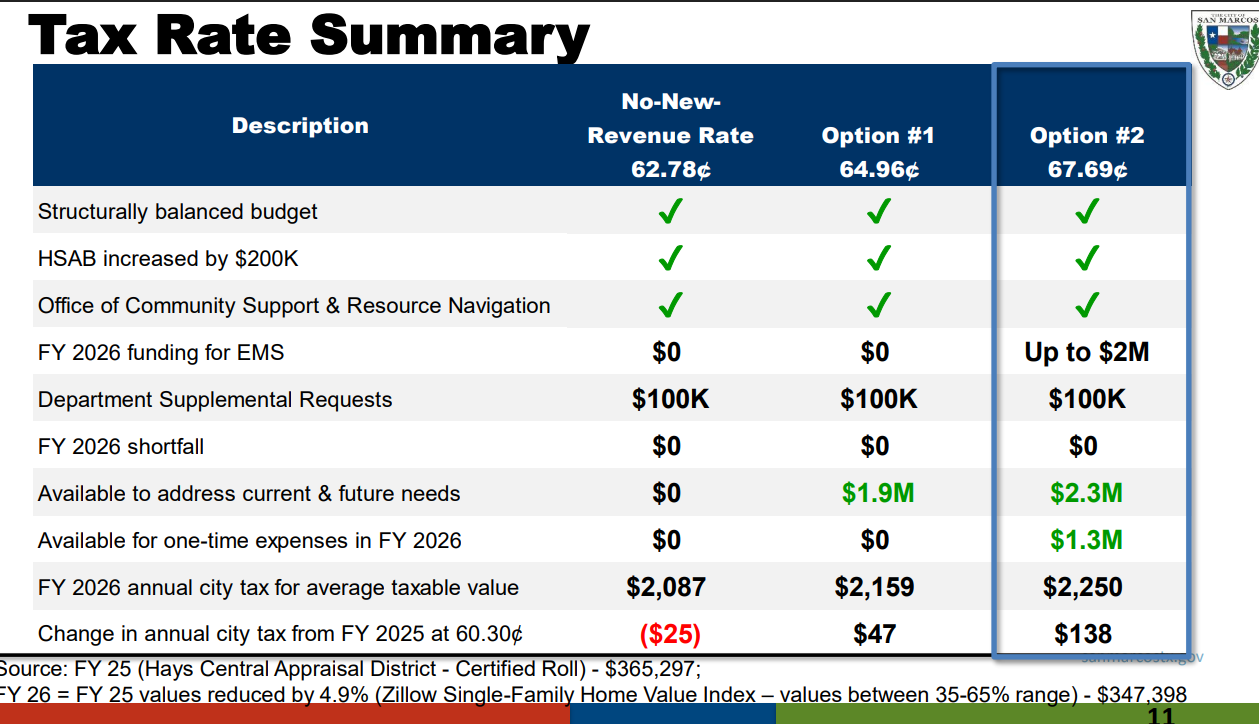

So staff lays out these possibilities:

That’s in the afternoon, at the 3 pm workshop.

Matthew and Saul are all willing to go up to the middle column now. The gravity of the budget crisis is evident to everyone.

The Lorenzo changes things up: “I want to go between 64.96¢ and 70.49¢. I want to land on the number that gives a $0 in that last row. Neither a surplus or a deficit forecast for 2027.”

Everyone is intrigued by this idea. He ends up successfully getting everyone on board with this! What careful planning we’re demonstrating!

That night, at the 6 pm meeting, they vote on the tax rate cap:

So we go with the 67.69¢.

This is our max: the final tax rate cannot be higher than 67.69¢.

…

Note: In August, they also mentioned something about an EMS study. It was another potential looming cost. This is going to become a very big deal, but it didn’t jump out at me then.

…

Last background month! We’re now to September.

September 2nd meeting:

They take the first official vote on the 67.69¢ tax rate:

Now you’re all caught up.

…..

This current meeting!

Here are the three scenarios we need to have on hand for this conversation:

What would home owners actually have to pay, if we raised rates in these categories?

-

- The “No New Revenue” rate, 62.78¢. (NNR) Your tax bill goes up $0.

- Option 1: 64.96¢. The average tax bill goes up $72.46 per year, or $6.03 per month.

- Option 2: 67.69¢. The average tax bill goes up $163.21 per year, or $13.60 per month.

….

Sidenote: Those amounts are based on an average house worth $347,398 (and $15K homestead exemption).

Most of San Marcos rents! But for those who own homes, home value varies a lot.

Here’s the average home price by neighborhood in San Marcos:

The last column is the monthly increase, under 67.69¢.

That chart has 40 rows. Only the last eight rows exceed the average home value! (Blanco Vista and Kissing Tree are both way bigger than they seem.)

Point being: most neighborhoods would see smaller tax increases under these proposed hikes.

….

The public outcry:

<crickets> …. <crickets>

There was none. I mean, I’m sure Council got phone calls. But I’ve watched these meetings for years now – compared to other years, this is nothing.

Two people showed up to talk about the budget during the public hearing. They both made nuanced points about the good parts and bad parts of the budget.

Contrast that to the big items this year:

- Tantra: 50+ speakers showed up.

- Gaza: 125+ speakers showed up (on the day of the vote)

- Data Center: 14 speakers on August 19th

People show up when they’re mad. This ain’t that. This is the wind at Council’s back, pushing them to make the responsible decision.

And then suddenly there is a big curve ball: EMS.

This came up in August, but it was uncertain. Now it’s certain.

So, there’s something called the San Marcos-Hays EMS. This is who you call when you need an ambulance. It used to be a lot bigger. Over time, Wimberly left. Then Buda left. Then Dripping Springs left.

Since the August meeting, it’s now official: Kyle and everyone else is leaving. So it’s just San Marcos. (The cheese stands alone)

This is a big problem! We don’t have a city-run EMS. We’ve got fire fighters who may be trained paramedics, but they can’t take you to the hospital. We don’t have ambulances. We don’t have a facility to store ambulances. We don’t have the infrastructure to run another department. But because this partnership is dissolving, we’re going to have to figure it out.

This is going to cost about $2 million. This will start getting dealt with in November.

Bottom line: those tax rates all need to increase by about 2.4¢ to cover EMS.

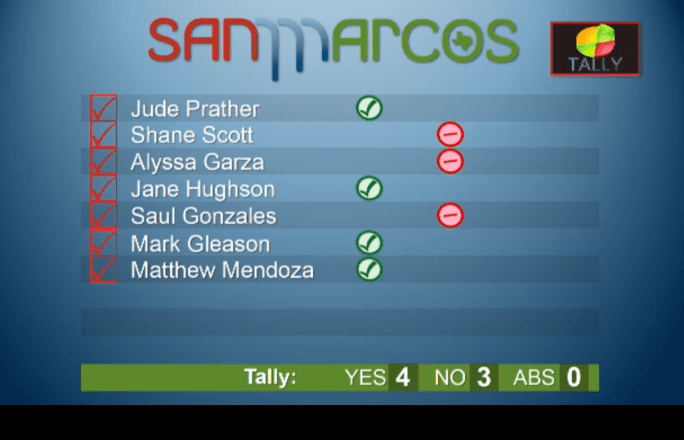

Council Discussion

Council asked a lot of questions about the EMS situation. They also were asking about Council priorities – what had to be decided on Tuesday, and what stayed flexible. It was not a very long conversation.

Lorenzo keeps acting squirrelly.

Finally he says: “I don’t like the 67.96¢ anymore. The State legislature didn’t pass those crazy laws after all. We should have more economic development! I want to go back to 64.96¢.”

Well, shit!

A few things:

1. “Economic Development”: I erased a big rant about this. It’s not a magic bullet.

This is like walking out onto the NFL sideline and telling the coach, “Hey, you should try to score more points than the other team! Then you’d win!” City staff really does know about economic development. They are always working on it.

2. The State legislature will definitely do Abbott’s bidding, and Abbott wants those laws. If not 2025, then watch for them in the next session.

3. The 64.96¢ isn’t an option anymore! It doesn’t include EMS!

The City Manager responds with alarm: “Please, please don’t go with 64.96¢. That won’t even cover EMS. We need at least 65.15¢.”

….

Listen: The rug just got yanked, suddenly, and nobody is prepared. Nobody has the presence of mind to call a time-out and fix all the numbers.

Confusion reigns.

But look how helpful I am! I made you a chart!

This is what I think city staff would have put on a slide, if anyone had had advance warning.

Here’s my theory: I think Lorenzo intended to go from the 3rd row to the 2nd row. After all, he said “64.96¢”. But since we now have an EMS crisis, he didn’t even cover the first row. The City Manager is asking him to please at least get to 65.15¢ in the first row.

…

We’ve suddenly rolled back all the careful planning for the budget cliff. The budget cliff is still coming! We still did all the planning! But instead, we’re about to do this:

I’m especially flabbergasted because Lorenzo himself was the one who promoted the 67.69¢. He literally picked it to leave us with a balanced budget in 2027 – neither deficit, nor surplus.

Saul, Shane, and Matthew were always barely willing to make a difficult vote. So as soon as Lorenzo gives them permission, the coalition for 67.69¢ falls apart.

The vote on 67.69¢:

Yeah.

Let’s have a time lapse:

(Technically, I’m combining two separate votes in that last column. First they vote for 67.69, and it fails. Then separately, they vote for 62.78+EMS. This passes.)

Anyway, that’s the whole saga! We had the wind at our backs, and instead we shot ourselves in the foot. It felt like someone whispered in Lorenzo’s ear at the 11th hour, and the whole thing unraveled.

Honestly, I’m kinda salty about the whole thing. .

…

One final note: $2 million for EMS is a bargain. That works out to 2 cents. By law, Emergency services is allowed to charge a special tax of up to 10 cents. That would bring in about $8.5 million.

Nobody is trying to shake down tax payers here. They just want an ambulance to show up when your grandmother has a heart attack.

…

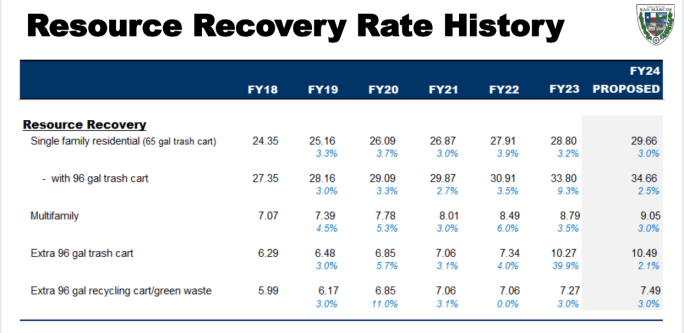

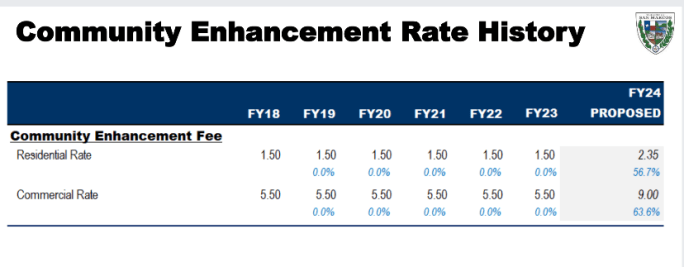

Item 4-5: Electric and Water Rates.

The next discussion is even goofier, if you can believe it. (But less destructive.)

Your electric bill comes in two parts:

- a base rate ($14.31)

- a usage rate. (Based on how much electricity you use.)

Usage rates are going up. (Discussed here before.)

Shane Scott speaks up:”Let’s just cancel the base rate!” He wants everyone’s bill automatically lower by $14.31 every month.

You can practically hear staff’s hearts all plummet through the floor as they try to grapple with this craziness. (Ten minutes ago, we tanked the budget over whether to raise taxes by $6 or $12 a month. And now Shane wants to throw away another $14?!)

The director of utilities tactfully explains that this would blow a $3.4 million hole in our budget. The city manager gently mentions our bond rating and debt service coverage. We could get sued by bond holders.

Shane withdraws his motion.

The vote on electric rates:

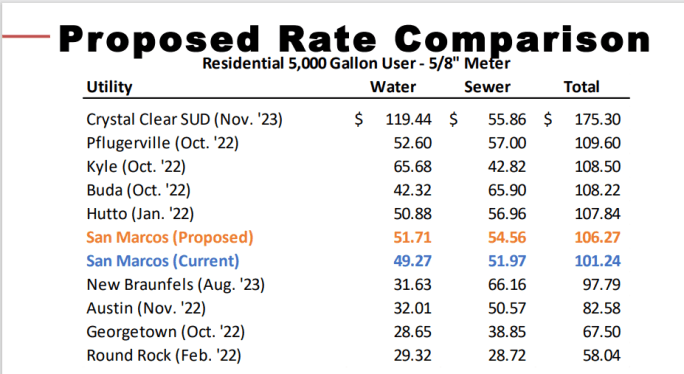

A little later, we have the vote on water rates:

So water rates will not change.

Listen: this is totally irresponsible. This is lazy, wishful thinking.

The city is not turning a profit on water. You have to cover the costs of your water utility.

If you want to save people money on their water bill, help them conserve water. Don’t strangle the department that has to fix the pipes and pay for the water rights.

…

That’s basically it for the meeting. I know barely anyone cares, but this was super big bullshit.