It’s budget season!

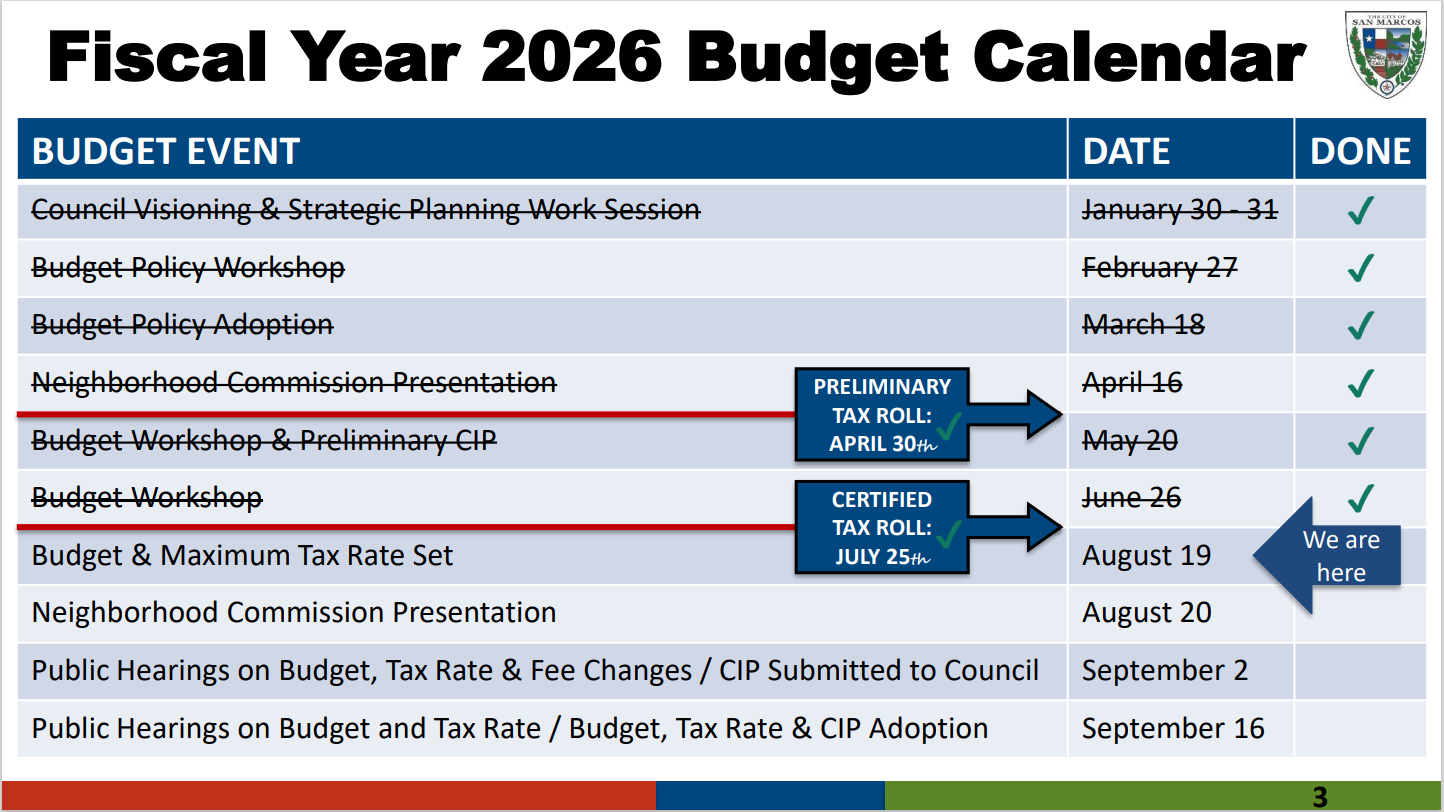

Here’s where we are in the timeline:

We finally know how much money we’re bringing in.

We get money from property taxes and sales taxes. In San Marcos, we’re split pretty much 50-50 between the two:

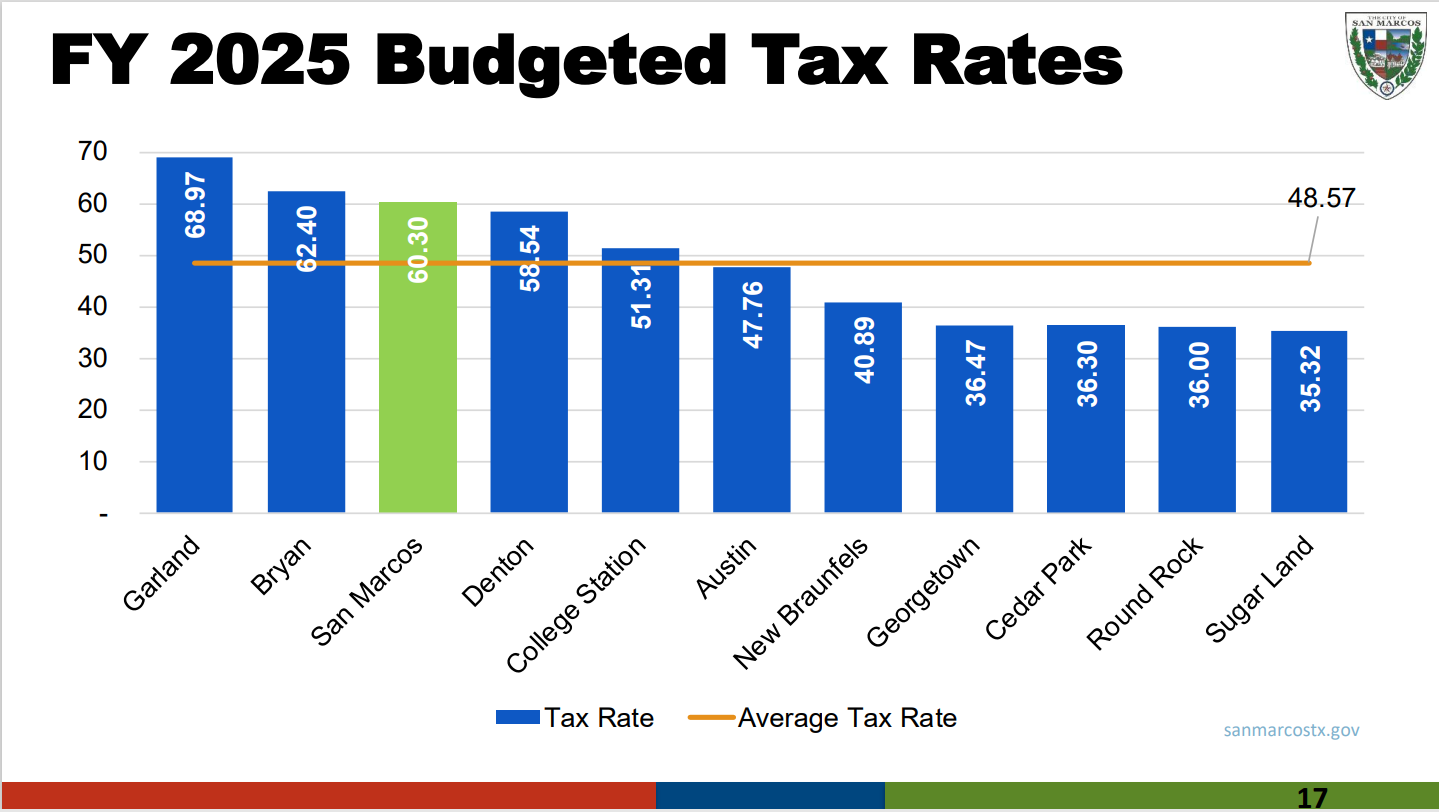

Our property tax rate is on the higher side:

but there are some reasons for that. For example, we have a lot of tax-exempt property:

particularly because of the university. You can also see Gary Job Corp on that map.

(I always love it when I-35 is drawn East-West.)

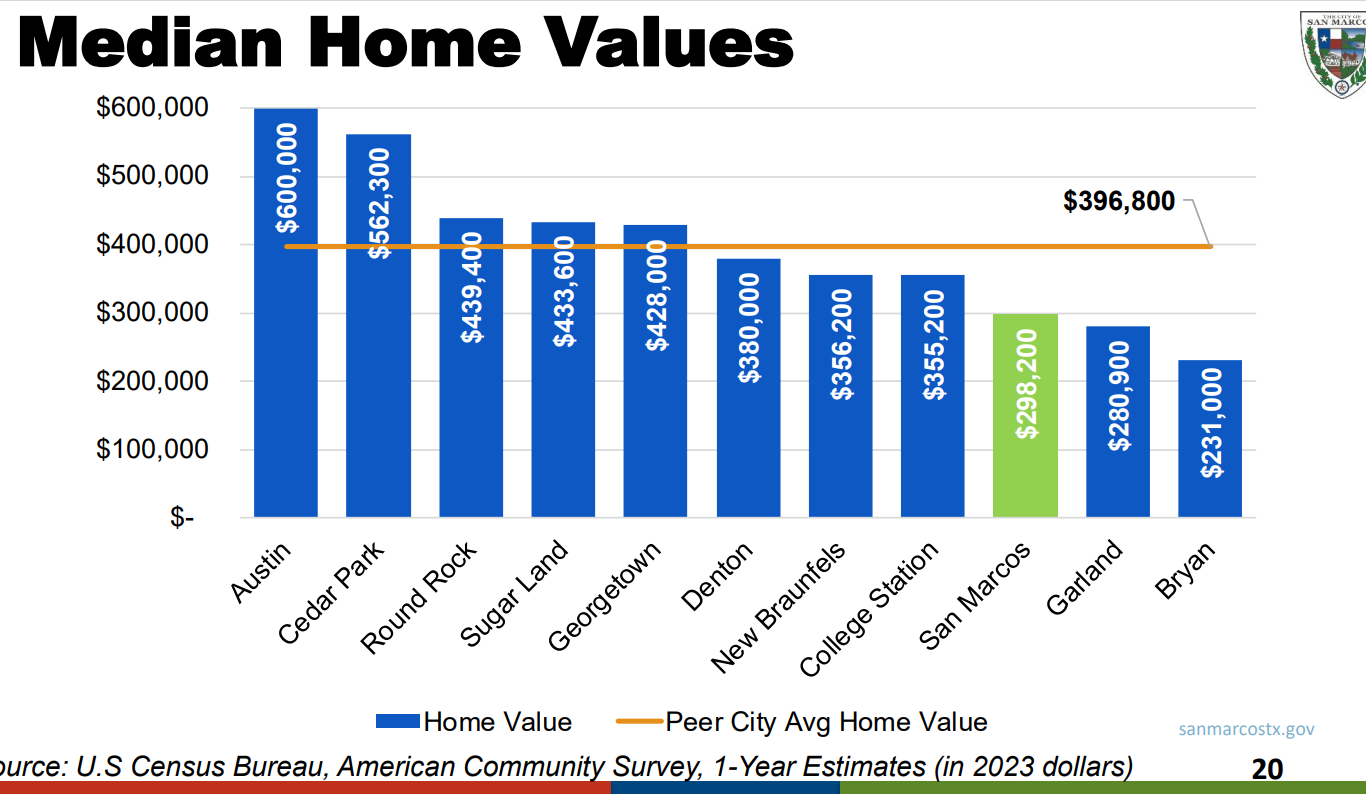

and also because our houses are less expensive on average:

and so we struggle to pull in enough revenue.

So altogether, here’s what an average person pays in property taxes:

Now if you’re a homeowner, your property taxes also include schools, county, and special roads district. So it’s actually significantly higher than that. That’s just the part that goes to the city.

Here’s how we’re doing on property taxes:

Sales tax dropped in 2024, and it sent our budget into a bit of a tailspin. But it’s working its way back up.

Here’s how much the city spends on each person, on average:

hey, that’s a bargain! $4610 worth of services for only $1798. That’s a better ROI than you’ll get from the stock market.

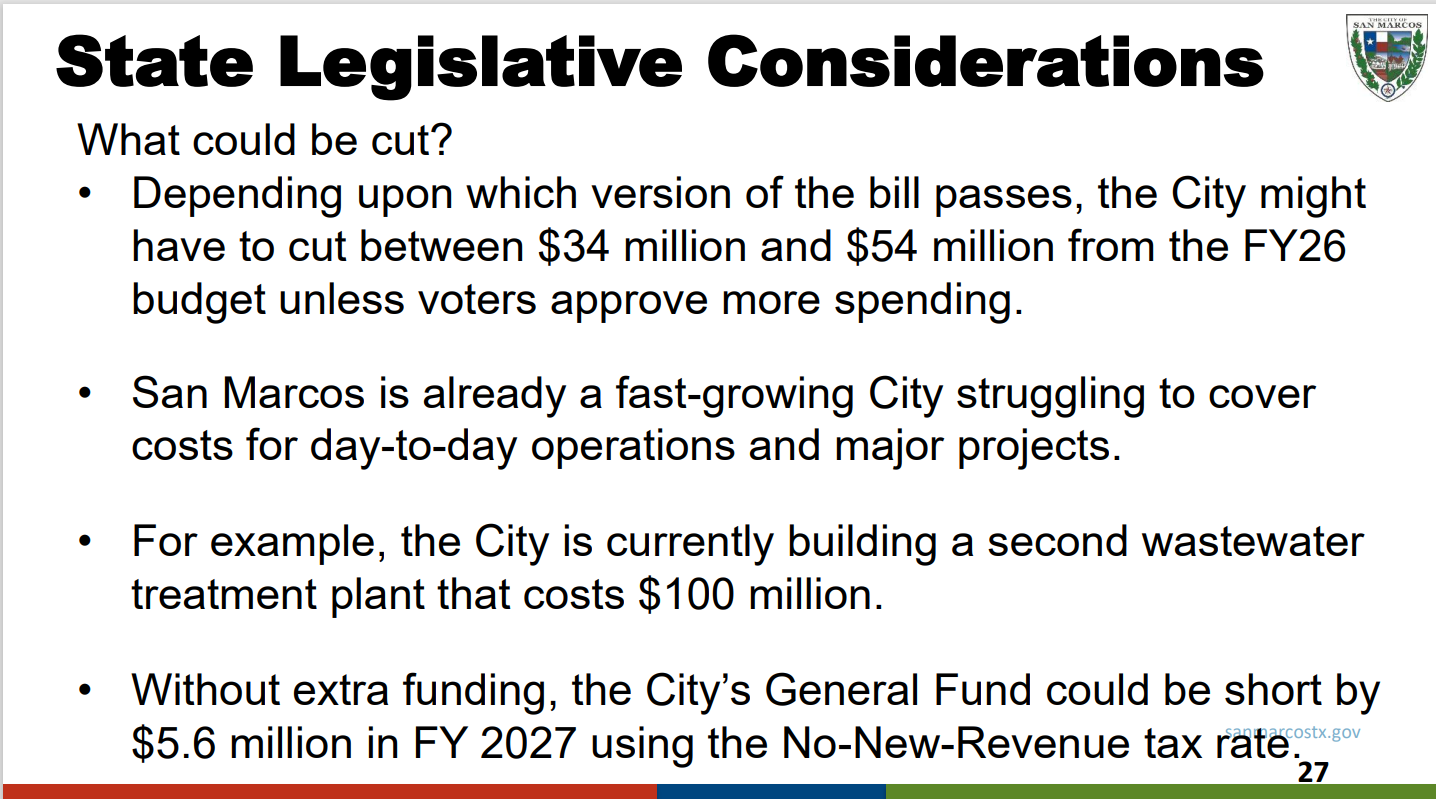

The state legislature is always trying to make everything harder on the cities:

because they are counterproductive twats.

Here’s how it might affect San Marcos:

…

Basically, we’re in a bind. Here’s two slides describing how we’re caught between a rock and a hard place:

and

Especially notice those last two bullets. The city is growing and inflation has been a big thing, and yet budgets have gotten leaner. This is not sustainable.

This brings us up to the current scenario. Council has a few choices:

The first one is the “No-New-Revenue” rate. If the property tax rate is 62.78¢, the average home owner will pay the same amount they paid last year.

In this case, we can skate by this year, and we’d be in the hole next year.

The next one is the Long-Term Focused Tax Rate, 64.96¢. This helps us keep up with inflation and growing expenses, over a longer term.

The last one is the Voter-Approval tax rate, 70.47¢. They’d never go for this, but in theory it would bring in a lot of money. Anything above 70.47¢ requires voter approval at the ballot box.

[Note: The (3,000,000) isn’t what it looks like. That’s balanced out by the “Fund balance in excess of 25%” line above.]

So what would we do, if we did the middle column of 64.96¢?

It helps plan for some financial cliffs that are looming.

…

Here’s these three tax rates, again:

The middle column buys us an extra year to plan for the looming financial cliffs. (The rate in the third column ends up lasting until 2028, and then we go to the red.)

…

You can probably see why that $9 million from the data center looks so helpful. 😦

…

What does Council think?

Matthew: I’m going with the ¢64.96 rate.

Saul: Same. ¢64.96

Lorenzo: If we go with the middle rate, will we be up this same creek without a paddle next year?

Answer: Somewhat. The state legislature may hamstring us, yes.

Lorenzo: How does tax rates translate into revenue?

Answer: Every penny brings in about $800K.

Lorenzo: I want to pick a number that heads off a projected shortfall in 2027. So I think roughly ¢67-68.

Jane: How would we prioritize cuts?

Answer: It starts getting into staff, because we’re already so lean. That’s a very hard question.

Alyssa: I don’t know.. I don’t have enough information. I’m willing to lean towards the middle, but I need to know more about how we’d use that extra $1.9 million.

Answer: Council can prioritize how we use it.

Alyssa: Then I can go with the ¢64.96.

Amanda: The legislative damage is highly likely to pass this session. Originally I was thinking ¢64.96, but I’m open to Lorenzo’s point about the ¢68. I want to take care of our employees, and making sure we’re keeping up there.

Jane: I want to see the impact on the average voter.

Amanda: Is it possible to see the impact on the average renter, as well?

Jane: I’m comfortable with the ¢64.96. And if the state school tax exemption passes in November, I can go a little higher.

They all want to see the impact on the average tax bill. How much would these new rates increase the tax bill?

…

They also discuss utility rates and other things. The Citizens Utility Advisory Board is recommending a 4% increase in electric rates.

This is slightly less of an increase than last year. Everyone’s goal is to make slow, smooth, steady increases, because otherwise after a few years, you have to make a giant leap in rate increases. That’s much worse

Commercial rates are a little higher:

Similar for the water/wastewater rates, trash, and community enhancement.

Here’s how all these increases will impact your monthly bill:

…

I’m returning to the end of the regular meeting, now. In Item 19, city staff returned with the answers to some of the questions above.

- How would these different property tax rates affect someone’s property tax bill?

64.96¢: additional $6/month

67.69¢: additional $12/month

68.17¢: additional $14/month

2. A list of possible things Council could fund with the extra money. (I couldn’t get a clear screenshot of this, though.)

Everyone has to weigh in with their max tax rate.

67.69¢: Alyssa, Matthew, Saul, Jane

68.17¢: Shane, Lorenzo, (but not committing. Just to give wiggle room), Amanda (same)

So! 67.69¢ is the upper bound this year for the tax rate.

This comes back on September 2nd!