Item 20: The Budget

This one item is nearly three hours long.

The budget is long and complicated. First off, city starts having workshops in January and runs them through the end of September, when they pass the budget.

These workshops are deathly boring and I am unable to sit through them. I’m sorry about this.

Notice that they present twice to the Neighborhood Commission:

heh. (via)

Anyway! Here are the strategic goals:

Sure, why not.

The budget is split across a bunch of different funds:

Each of those colored headers is a different fund. So you can see the General Fund on the left is the big one, and there are a lot of little ones as you move right.

Revenue

Last year, we took in $37 million in property tax, and $42 million in sales tax. So sales tax is huge for us.

The problem is that sales tax revenue took a big hit this spring:

I know that’s not very dramatic-looking. Here’s how they presented it over the summer:

They kinda know what went wrong now. Here’s the biggest sources of sales tax:

Basically, some of the top sales taxpayers had unusually high sales for the past few years, and now they’re reverting back to normal. But we had banked on those returns to keep increasing. Whoops. (I’m guessing it was post-covid supply chain kinks working themselves out, especially Matheus Lumber.)

We’re going to start a sales tax volatility fund to help hedge against this kind of fluctuation.

…

Most departments are going to have the same budget as last year. Since inflation is about 3% and the town is growing, that means they have to cover more ground with less money. So that sucks.

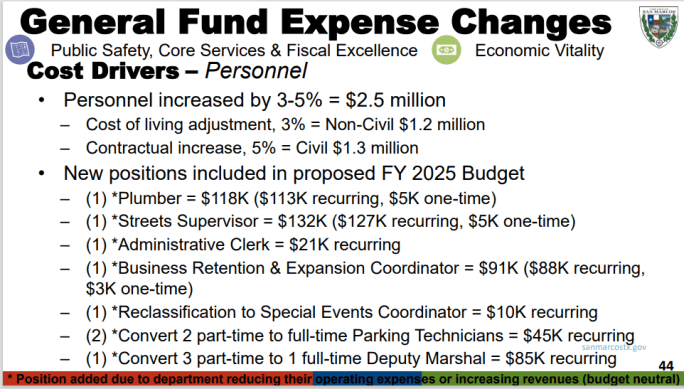

We’re doing a little hiring. These are the budget-neutral positions being added:

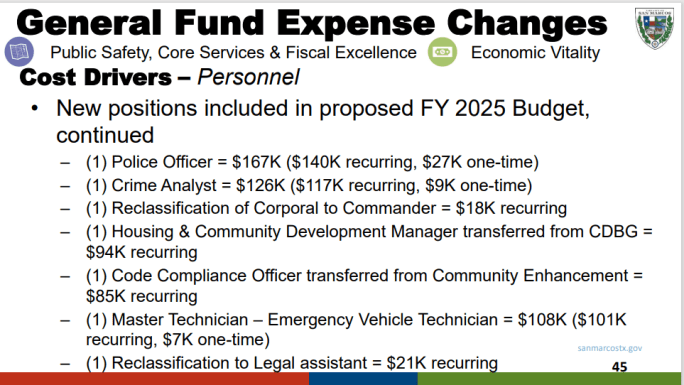

These are the ones that aren’t budget neutral:

…

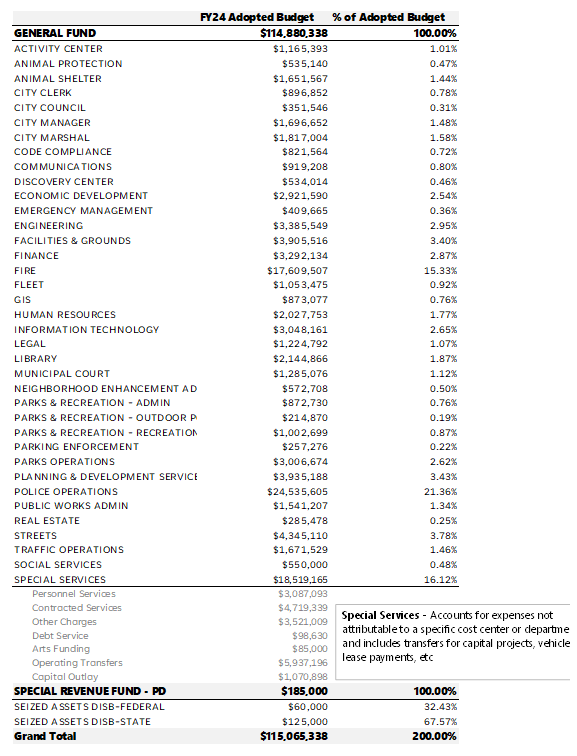

I find it extremely hard to get a handle on the General Fund budget. So last year, I filed a FOIA to have them send me a list of how much each department gets from the General Fund.

This is what they sent me:

This is really helpful! This is how my brain works. That’s very clear to me.

What I plan on doing is put this side-by-side with next year’s proposed budget, so we can see what areas are growing and what is shrinking. (I filed a FOIA for the new one, but it’s still being processed.)

…

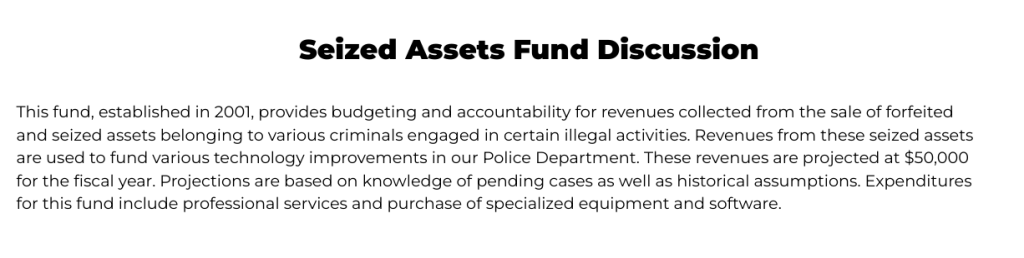

Another day, we should have a conversation on the $185K of seized assets, at the bottom of that chart. Seized asset forfeiture is wildly unethical! Have another link. It’s really bad.

Here’s what it says in the 24-25 budget:

There are not enough details on the $185K – what’s it being spent on? Was that all seized in San Marcos? Why is there a state and federal part? I have no idea.

….

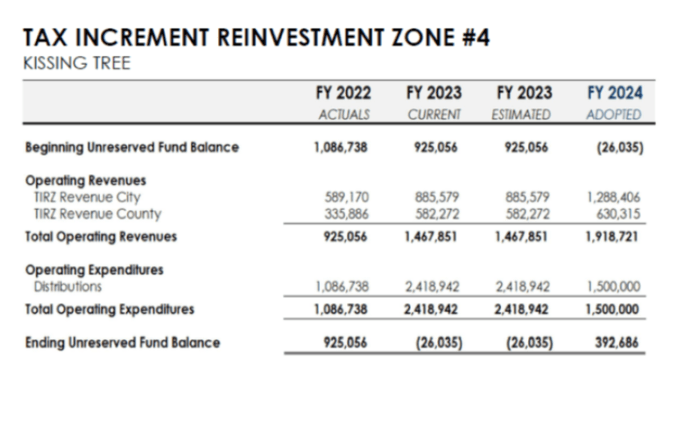

Let’s talk about TIRZes. These also aren’t discussed much.

A TIRZ is a Tax Increment Reinvestment Zones. What this means is that the taxes from those zones mostly go back to those zones. We have six of them, maybe?

The example you’ll hear about most often is the Mainstreet Downtown TIRZ, because we can all appreciate it. We all want a thriving downtown! Taxes from downtown stay downtown, to keep downtown nice and vibrant.

But let’s focus on the Kissing Tree TIRZ, instead. Here are the details from the 23-24 budget:

So San Marcos sent $1,288,406 of tax dollars back to this one single gated community last year. Did you enjoy a thriving Kissing Tree or a thriving downtown more? Which ones benefit all of San Marcos? Feel free to compare $1,288,406 to your favorite category in the General Fund, above.

The other TIRZes are Loop 110, the Downtown plan, the Embassy Suites Conference Center, and maybe Blanco Vista? I can’t tell if that one ended in 2022 or not.

This year’s budget does not have a TIRZ breakdown either, which I find annoying.

…

Let me be clear: city staff does an amazing job trying to clearly communicate the budget. No one is withholding anything maliciously.

I just think that the breakdown of the general fund is a bit of a blindspot. It would help if it were there.

Here’s the city budget webpage, if you’re curious to poke around yourself.

…

I’m skipping over a lot – there’s SO MUCH.

Utility rate increases are being discussed. It’s generally much wiser to raise rates by small amounts every year, rather than letting it accumulate and then needing a giant increase.

Alyssa Garza is opposed, out of economic concern for our neighbors. I think she’s wrong here. Starving your government is how you let capitalism run unfettered. Don’t be a shill for Reagan.

…

That said, we do have a utility assistance program. The DEI coordinator gives a presentation on it.

The city puts about $230K from various sources into utility assistance:

And here’s what we handed out:

There is lots of anecdotal evidence that we do a mediocre job connecting with community members who need help:

One thing that makes it complicated is that there are two kinds of people who need assistance.

– First, people who need wraparound services in lots of areas. These people benefit from filling out the mountain of paperwork needed for federal programs. Community Action does this.

– Second, people who just need a one-time boost to get out of a hard spot. These people benefit from a low-barrier process and quick payment, so that their utilities don’t get turned off.

There is going to be a work session to try to make all this more effective.

…

Final notes:

- There’s some discussion on how the Airport has been in the red for a long time, but I can’t find this info in the slides.

- As ARPA money comes to a close, we’ll have to pick up a bunch of slack in the budget next year. So more expenses are looming.

That’s the end of the three hour budget discussion!

…

But wait! There’s more!

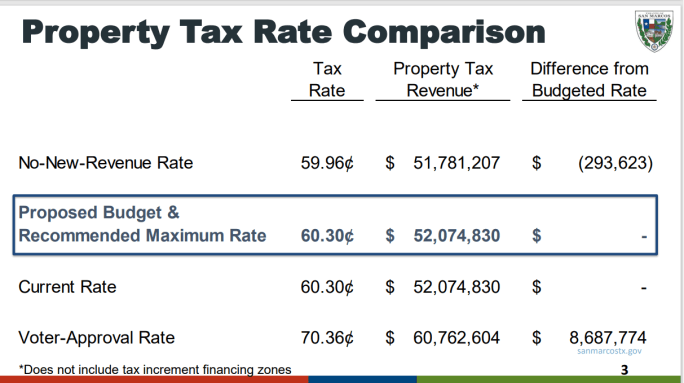

Item 21: Setting the max tax rate for the new budget.

Background: here are some different tax rates:

That’s all just different vocabulary for levels of property tax rates. City Council can pick any number it wants, although if they go over 70.36 ¢, they’d have to get voter approval.

This whole budget above has been planned on the 60.3¢ number. Here’s how it would affect the budget if we raised or lowered the tax rate:

The 60.3¢ rate is the same rate as last year. Of course, if your home value goes up, then your taxes go up, even if the rate stays the same.

Home values really have shot up:

So how much more is the average home owner paying?

If Council goes with the 60.3¢ rate, the average homeowner will pay $164 more this year, or $14/month.

My prediction: The next few meetings will see a lot of focus on home owners in poverty, and whether its fair to ask them to pay $14 more per month. Some considerations:

- Most people in poverty do not own homes. But there are definitely some, and they deserve compassion. However, they’re likely to own less expensive homes. So if $14/month is the average increase, maybe for a homeowner in poverty, it’s more like maybe $10/month.

- Focusing on home owners in poverty allows us to avoid a conversation about wealthy home owners.

Today: just setting a ceiling. What’s the upper bound for the tax rate this year? (This is just a weird Texas quirk.)

The vote to set the maximum at 60.3¢:

I have no idea why Shane voted no.

…

Item 26: We’re giving Southside $800K to Southside from ARPA money to implement the Homelessness plan.

Over the summer, we fronted them $50K to come up with a working plan, which they’re now presenting. It’s really thorough! Unfortunately, the slides aren’t in the packet, so I’m relying on screenshots.

The three strategies:

- Stop the growth

- Improve existing systems through effectiveness and efficiencies

- Expand Capacity

Honestly, I’m not an expert, but she sounded way better than Robert Marbut. Feel free to listen, starting at about 4:56 here.

These are just some of the slides:

” – We will hold a community-based network to help neighbors in need.

– We will use best practices and data-driven decisions to guide our work

– We will implement collaborative technologies to support coordinated services

– We will honor the humanity and dignity of all people and help the entire community to thrive”

Target population: Those experiencing homelessness or at risk of homelessness

- San Marcos resident families at risk or experiencing homelessness for the first time

- Those with a recurring situation

- Individuals at risk or experiencing homelessness for the first time, or in an episodic manner.

Key Deliverables:

- Activate a network of community partners and volunteers to help neighbors in need

- Develop a homelessness prevention and rapid rehousing framework

- Implement coordinated entry processes for easier access to services

- Establish standard intake procedures for streamlined client onboarding and information sharing

- Implement a client management system, like HMIS, for secure data storage and reporting

So you don’t want homeless people having to supply data and information to a dozen different people in order to get help. You want to get someone in the system one single time, and then let the providers talk to each other and coordinate a response to get help to that person.

It sounds like we’re going to use HMIS:

A big piece of this is stabilizing people who are right on the brink of becoming homeless, or who just went through a crisis:

They’ve already started on this:

It’s just an extremely complicated problem that requires lots of human scale collaboration to put all this together.

One big piece of this is expanding capacity – we literally need more beds.

Again, it’s probably worth it just to listen for yourself. I’m struggling after a long meeting here.

….

After this, Council zips through a ton of items super quickly:

- Whisper North and South, and Trace all get their annual thumbs-up. (Whisper North and South are giant planned neighborhoods on the east side of 35, at Yarrington Road. Trace is down south, past the outlet malls, also east of I35. These are all PIDs: Public Improvement Developments. It’s similar to a TIRZ. This is where my knowledge ends. Maybe they’re smaller? idk.)

- The Intralocal Agreement with CARTS to provide transit in San Marcos gets re-upped for another year. Also one with the university.

- Something something new roles on the Finance and Audit committee, we’re all pretty drowsy at this point. Shane Scott tries to kill off the whole Finance and Audit committee, but its very existence was not on the agenda, so he’s stymied.

That’s about it!