Presentation 1: Our budget is not doing well. Let’s look at some slides.

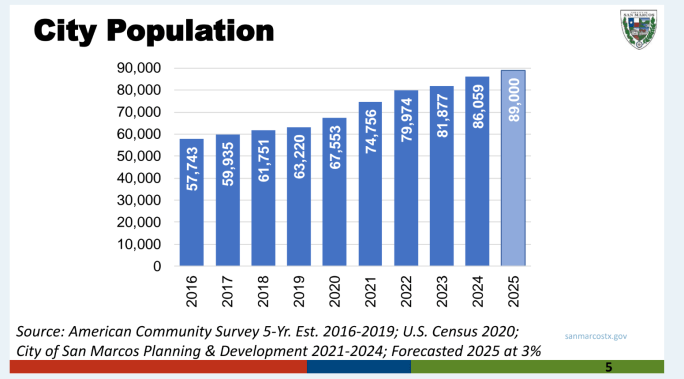

First, San Marcos keeps growing:

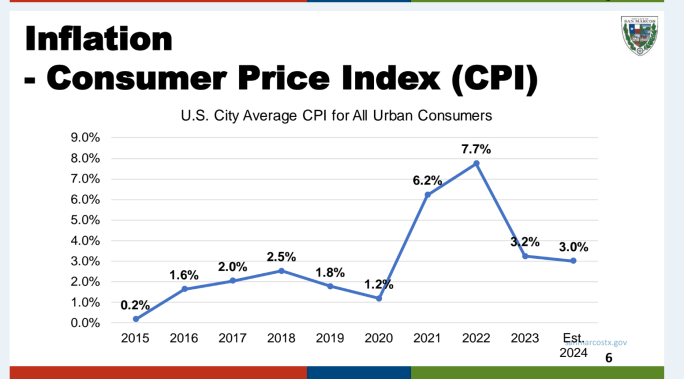

And while inflation is back to a normal healthy amount, it still exists:

So due to a larger population and 3% inflation, it will cost more to run the city more next year, even if we don’t change what we’re doing.

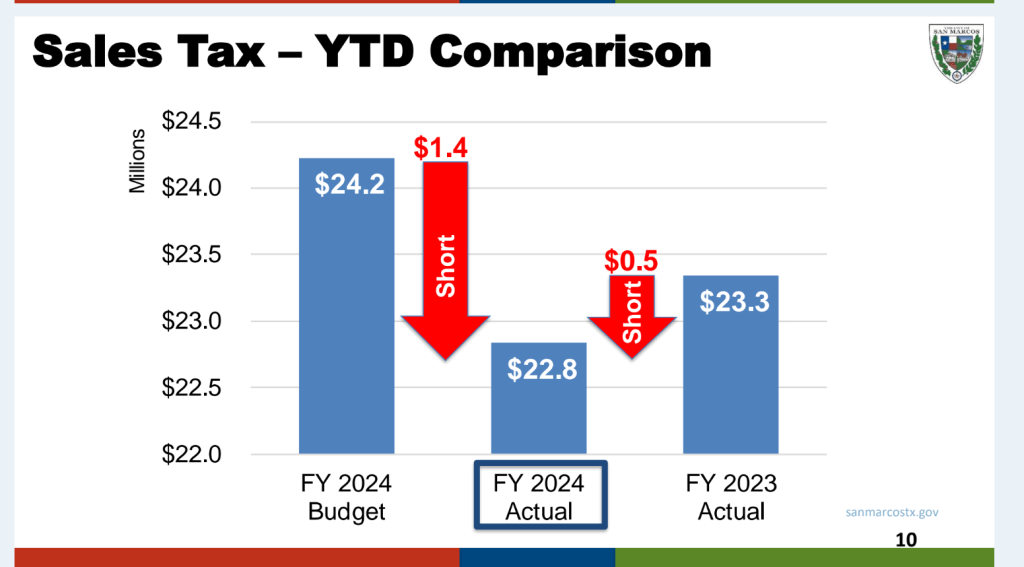

But unfortunately, we took a big hit on sales tax:

This is sort of a cumbersome chart. It’s doing a few things simultaneously.

So you see where it says October 2023 is 6.6%? What that means is:

- Average all the sales tax revenue from October 2021 to October 2022.

- Average all the sales tax revenue from October 2022 to October 2023.

- Work out the percent growth from the first average to the second average. For October, the past 12 months were 6.6% bigger than the previous 12 months. Great!

But you can see how this plays out over 2024 – we kept shrinking and then turned negative. So the average the sales tax income from April 2023 to April 2024 is smaller than it was over April 2022-April 2023. That is not good.

Who’s coughing all this up, anyway?

I would not have guessed that!

(I would say it’s their customers, not the business, but you get the point.)

No one else is having this problem. Just San Marcos:

No one offers up an explanation, because I don’t think anyone has one? Nobody knows if this is a shortterm fluke, or if it’s the beginning of something bad. We can’t know until it plays out a little more.

Anyway, here’s the bottom line:

We do not have the money we thought we’d have this year.

So we have to do two things simultaneously:

- Figure out how to tighten our budgets mid-year. There are established contingency plans on how to do this, but it’s not, like, fun to do.

- Figure out how to plan for the 2025 budget, if we’ve got more people and slightly higher prices, but less revenue.

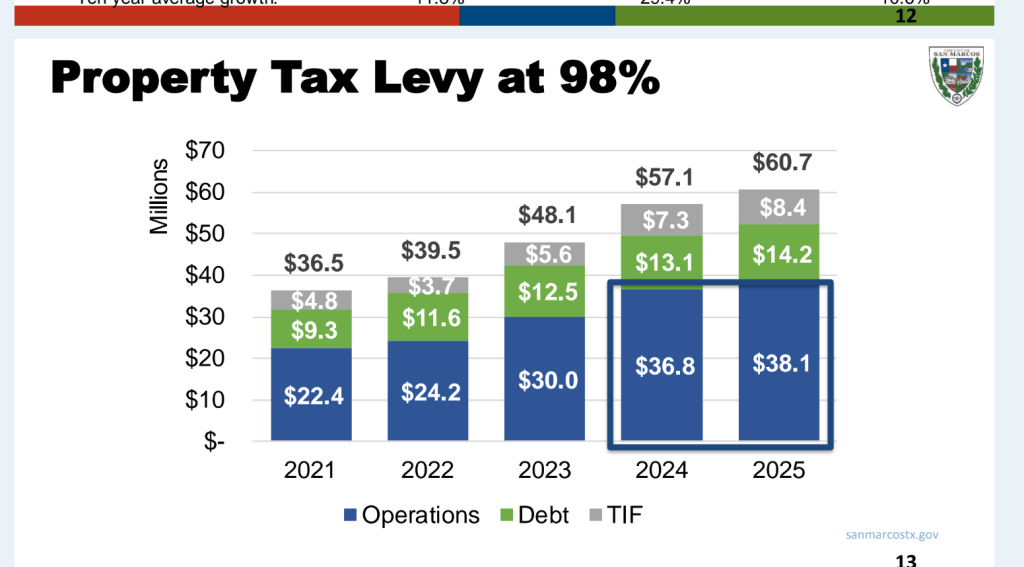

Can property taxes make up the difference? Basically no.

First off, sales tax is a bigger chunk of our budget than property taxes:

But second, even though homestead prices are going up:

they’re not going up by as much as they had been going up.

The blue portion is the key amount:

So the city is expecting to collect 1.3 million more dollars next year than this year. It’s growing, but not enough to keep up with inflation and a larger population. Not like the past two jumps: from 2023 to 24, we jumped 6.8 million, and the year before that, an extra 5.8 million dollars.

So here’s the bottom line:

We are looking at being 2.3 million short this year, and 1.12 million short next year, if we don’t do anything different. Ouch.

I mean, we’re going to tighten belts, etc. The city is smart, there are plans to implement. But they involve hard choices and going without good things.

Here’s how we’re handling 2024:

Basically, that’s how they’re handling it. And they’re working on making next year’s budget work on a shoestring, as well.

One last thing:

There’s a new law that caps the how much business property appraisals can increase each year. Any non-homestead can’t grow more than 20% in a year. Or rather, the appraisal can come in higher than that, but you won’t be taxed on the excess.

Now, this only affects businesses appraised under $5 million. The problem is that we have a high number of small rental properties, and they all qualify. So we’ve lost $123 million of taxable land value, which works out to $745K from the budget.

Bottom line: the city has to tighten the budget. Kinda a giant bummer.

…

Presentation 2: There was also a presentation on the 2025 Capital Improvement Plan.

The CIP plan is all the major city projects, like re-doing the drainage for a street so it doesn’t flood anymore, or whatever. Basically it takes a lot of longterm planning. I don’t have much to say about it besides that they emphasized how much they’re trying to apply for lots of grants.