Items 21, 24, and 25: If you want to understand the budget, it’s probably worth going back and listening to the August 18th budget workshop. But I’ll do my best.

First off: it all comes down to property taxes. Property taxes are steep. But let’s zoom out for a second:

- Most of San Marcos rents. Indirectly, property taxes get passed on to renters, but that’s not the main reason rent goes up. Rents have gone up because landlords realized they could get away with it. When we talk about property taxes, we’re mostly ignoring renters.

- Texas taxes are regressive. Poor people pay 10.9% of their income in taxes, whereas the wealthiest people pay 3.1% of their income in taxes. Details here.

- Texas could do a lot to alleviate poverty. For example:

The United States can easily afford for every person to have a safe home, free healthcare, and access to healthy food and education. This country is extremely wealthy. Collectively, we can afford to lift everyone out of basic poverty. But we don’t choose to do so.

So: do property taxes force people from their homes? In one sense, yes. A $5000 tax bill is huge, and it can be the final straw, for a financially precarious person or family.

So should we be mad about property taxes? No. Poverty forces people from their homes. Be mad at the state and national elected officials who are complacent about poverty. Do not misplace your anger about poverty onto property taxes.

We should work hard to keep property taxes from being the final straw that forces anyone out of their home. But the actual problem is not the local property taxes themselves.

Let’s break down property taxes:

Last year, the city had a property tax rate of 60.3¢ per $100. Let’s say you have a house, you lucky home-owner. Now, city taxes aren’t the only property taxes you pay. Total, you would have paid $2.0492 per $100 of value. (Source.) Then that gets divvied up between the city, SMCISD, the county, and the special roads district.

Say your house was worth $250,000. Then you paid $5123 in taxes. It breaks down like so:

$ 2868.88 to SMCISD (56%)

$ 1485.67 to the city of San Marcos (29%)

$ 717.22 to Hays County (14%)

$ 51.23 to Special Roads District (1%)

So far, so good.

The problem is that home prices went through the roof last year, right?

Suppose your $250K house is now appraised at $400K. You should not freak out! First of all, the state of Texas caps the increase for property taxes at 10%. So you aren’t going to be taxed on $400K. The most you could get taxed on is $250,000 x 1.1 = $275,000.

Second, the city has a homestead exemption. If you live in your house (as opposed to renting it out), then you can file the paperwork and get a deduction for $15,000. So instead of getting taxed on $275,000, you’re now getting taxed on $260,000. Fine. (If you’re a senior citizen or have a disability, you can get another $35,000 taken off.)

The city has boiled it down to two scenarios:

- They could charge you the same rate, 60.3¢ per $100, and this time you’d pay them $1567.80, based on your house being worth $260,000.

- They could charge you one penny less, 59.3¢ per $100, and you’d pay $1541.80.

The city has drawn up a budget based on 59.3¢ per $100. The big issues are:

- What’s in the 59.3¢ budget?

- What would be done with the extra penny, if we went for the 60.3¢ rate?

What’s in the 59.3¢ budget?

Obviously, everything is in it. It’s a budget. That said, they emphasized a few things in the presentation:

- Personnel challenges: We’re terribly understaffed, across the board, and it leads to burn out and people taking jobs elsewhere, which perpetuates the problem. So, personnel challenges. The budget includes a 5% raise for all non-civil service employees. (Ie, the less highly paid public employees.) Everyone gets a one-time retention incentive. Funding for an additional 47 positions (2 funded from elsewhere).

- Additional funding for CASA, GSMP/Splash co-working, art center

- Squirrel some money away for future City Hall. (There’s a state law that you can’t borrow money to fund you city hall, and the voters will never approve a bond for a new city hall building. So you have to squirrel money away for it.) (Which is actually financially not great, but there you have it.)

- All the regular business as usual, of course: CIP projects, parks, planning department, utilities, police, fire department, municipal courts, etc.

What would be done with the extra penny?

If rates are 60.3¢ per $100, then the city will bring in an extra $700,000 with this. According to the city presentation, the average house is worth $245,197, after all the deductions and everything.

– At 59.3¢ , city taxes would be $1,454.02

– At 60.3¢, city taxes would be $1,478.54

So, a difference of $24 per household, on average.

The $700K would be used for six new positions, which could be either fire fighters or police officers.

Mayor Hughson suggests going for the 60.3¢ rate and letting staff decide how the six positions should be split between SMPD and fire fighters.

Alyssa Garza says she’ll vote against the 60.3¢ rate until she’s consulted with more community members.

Shane Scott says he wants the 60.3¢ rate, and he specifically wants 3 firefighters and 3 cops.

Saul Gonzalez is in favor of the 60.3¢ rate.

Jude Prather is in favor of the 60.3¢ rate.

Max Baker is opposed. Largely, he argues that having more cops does not make us safer. Instead, it increases petty citations. He criticizes the outreach efforts of “playing basketball” and instead wants to see more town halls and more data driven discussions.

Max is way off on that last point. “Playing basketball” is shorthand for taking time to build trust and relationships with teenagers in neighborhoods. This is how you begin to counteract the cop mindset that young men are all potential criminals. Cops and young adults need to have healthy, non-punitive interactions and build relationships.

Max Baker says two other things: we should be reviewing officer duties and seeing what can be removed. (I like this!) And he praises the presentations that Chief Standridge has given at the Criminal Justice Reform committee meetings.

Mark Gleason’s take is interesting. He feels tortured over the decision, but comes out against the 60.3¢ rate, at this point. His neighbors are getting forced out of their homes due to property taxes. (Later, he’ll change his mind. But his angst is real.)

Mayor Hughson says she’s also worried, but this is a $24 difference. That’s $2 a month.

Chief Stephens and Chief Standridge both get a chance to plea their cases.

Fire Chief Les Stephens talks:

- In 2009, 46% of the city was outside of the effective coverage area of all the fire stations

- He’s relocated firestations and done his best, but with the growth, etc, it’s still just slightly lower than 46%

- Worst part: far northern part.

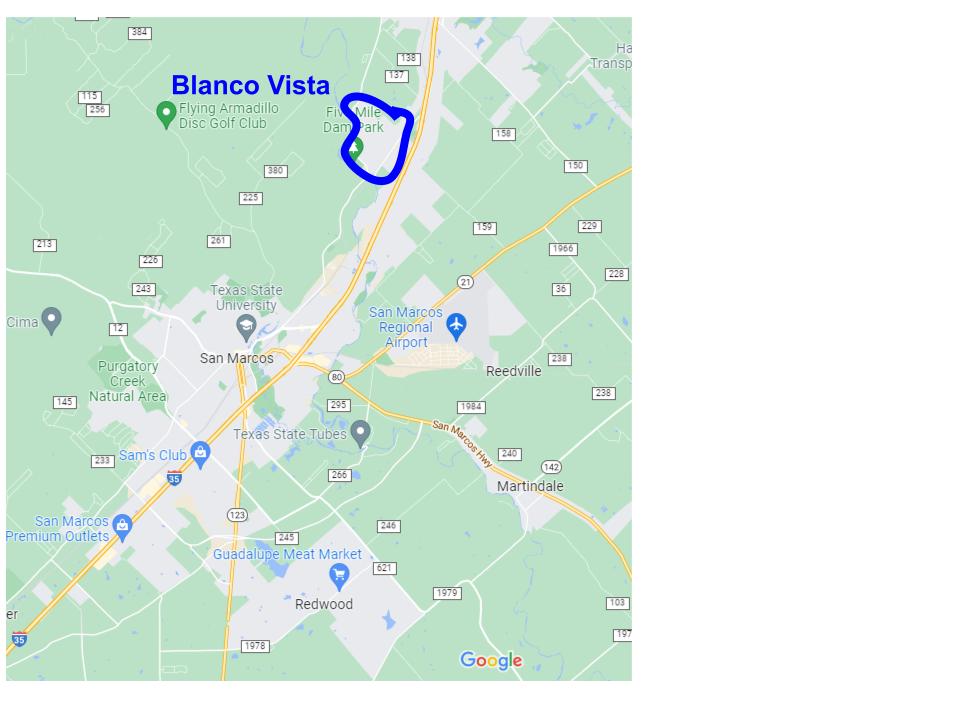

- Firestation 5 is the northern most station. Blanco Vista plus Whisper Tract.

- Currently, it takes 15 minutes and 10 seconds to get from Firestation #5 to the deepest part of Blanco Vista. That’s the best case scenario.

- If Firestation #5 out on any other call, Station #1 downtown is the next best. It will take them 21-22 minutes, in a best case scenario.

I know you know where Blanco Vista is, but look: it’s not close.

Sprawl is a really big problem! It takes 15 minutes to get to someone having a heart attack in the upper corner of that blue region!

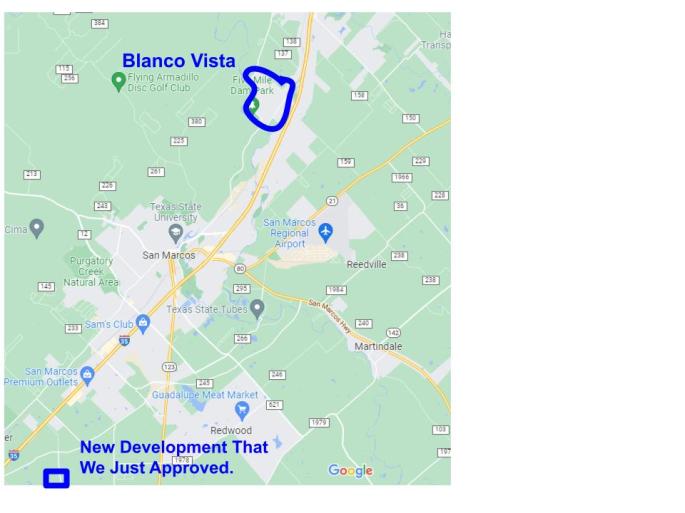

And in this VERY SAME MEETING, we approve the little development by the Hays Power Plant, discussed here:

Equally far away, but in the opposite direction. WHY?!? The Chief just said he needs 27 firefighters to cover the existing city, and we’re funding three of them. The problem is the sprawl!

A few other points from Chief Stephens:

- Insurance rates are tied to ratings. If our PPC safety rating goes down, everyone’s insurance goes up. So saving $24/year in taxes could cost you more in insurance, later on.

- We want to buy a run down beater firetruck to use as a blocker, on I-35 or any time traffic is blocked, so that they can use their expensive trucks for calls. Takes 1 person to staff instead of 3. Seems like a good idea!

Next, Chief Standridge talks about SMPD:

Philosophically, can a police chief be progressive? Or are they doomed because they’re trapped in a toxic culture? I don’t know. But if it’s possible, Chief Standridge is making an appealing case.

He validates everything that Max says. He agrees that more cops don’t equal less crime, and he builds a case that we are already implementing the crime-reduction things that don’t require extra officers:

Since he got here:

- Implementing intelligence-led policing (I love names like this that insult the alternative. What exactly had we been doing before?)

- Build an intranet database of everything a cop might need to know

- Twice-monthly collaborative crime meets to work on highest repeat offenders and highest repeat call locations (This is really important.)

- Stopped sending officers to minor crashes that do not result in injury

- Stopped sending officers to child custody calls. The idea is to keep custody disputes in family court, and out of criminal court.

So, to Max’s point about looking to see what duties can be removed, Chief Standridge is saying we are doing that.

- Doing some kind of big legwork thing to keep high-repeat violent offenders locked up

- Redid the downtown unit. During the afternoon and evening, they serve as a Crime Reduction Unit – preventative violent crime measures. Then they head downtown as the town square heats up.

- Re-imagining mental health. Next week someone from some state org will come in to help re-invent how we respond to mental health and our behavioral advisory team

- Homeless outreach team. We have 5 members focused on homeless help. Not issuing citations.

- Used to have 1 internal affairs manager. Now we have 4 internal affairs investigators, all with state training. (I do NOT approve! Misconduct should be reviewed by external, independent investigators. But still, 4 is better than 1.)

- Extra officers needed for in-progress violent 911 calls. Right now, it takes 8.5 minutes to get there, on average. Takes 3 minutes just to find an available officer. We need 10 officers.

- Civilian liaisons: this is a new program where SMPD will hire regular civillians to take incident reports and direct traffic, and free up cops to do cop-things. (I am worried about George Zimmerman types being attracted to this job.)

Chief Standridge’s bottom line is that he’d like four more officers to respond in-progress violent 911 calls, and three to work on community outreach. If the $700K goes through, he’d probably get three new hires towards 911 calls.

Council discussion:

Shane Scott asks the cutting questions: SHOULD POLICE OFFICERS BE REQUIRED TO HAVE COLLEGE DEGREES???

Standridge cries, “no! We can incentivize it, but please don’t reduce our applicant pool!”

Saul asks if annexation cause problems?

Standridge answers: “We’re doing a cost study to answer that.” (But seriously. How could it not?!)

Mark Gleason says he’s now in favor of the 60.3¢ rate, after all.

Saul Gonzales says he’s in favor of the 6 new positions, at the 59.3 tax rate.

Jane Hughson tells him he can’t do that. The six new positions come from the 60.3¢ rate. It’s a package deal.

Saul says he’s doing it anyway! He’s in favor of cops, firefighters, and lower taxes, and opposed to staking out unpopular positions. Gotta love Saul-on-the-campaign-trail.

The vote on the budget:

Yes: Jane Hughson, Mark Gleason, Jude Prather, Shane Scott

No: Alyssa Garza, Saul Gonzalez, Max Baker

Alyssa reiterates that her intent is to find out more from the community, and then base her decision on that. So here’s my two cents:

At the moment, I have a fairly high degree of trust in Stephanie Reyes, Chief Standridge, and Chief Stephens. So I’m mildly in favor of the 60.3¢ rate, although I won’t be heartbroken if we decide against it.

…….

Item 22: Stormwater Rates

We have $25 million of flood projects to be done. We have about $6 million so far. They are proposing raising stormwater rates to help pay for a little more of it. If you have a small house (less than 2000 sq feet), your rates would go up $10/year.

Increase stormwater rates?

Yes: Alyssa Garza, Shane Scott, Max Baker, Jane Hughson, Mark Gleason

No: Saul Gonzalez

Absent: Jude Prather

It feels like Saul is being weaselly for re-election. What is this.

Item 23: Trash and recycling

Here they will probably not raise rates. There’s some 3% surcharge that we’re contractually obligated for, but the recommended rate hike above that will get voted down.